Metalli preziosi: transizione verso un mondo post-pandemia

una relazione di Daniela Corsini

Abstract

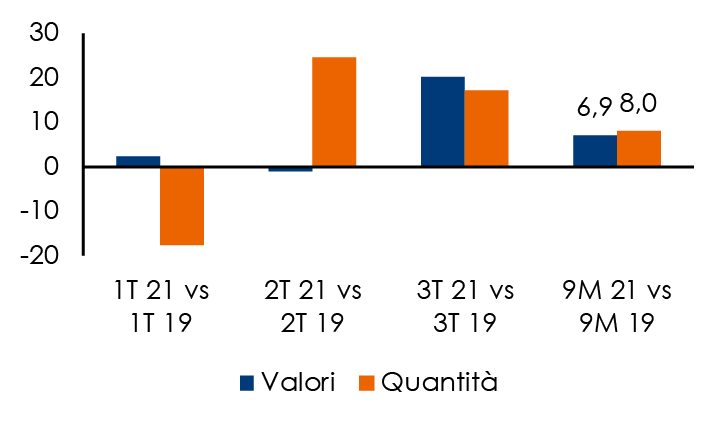

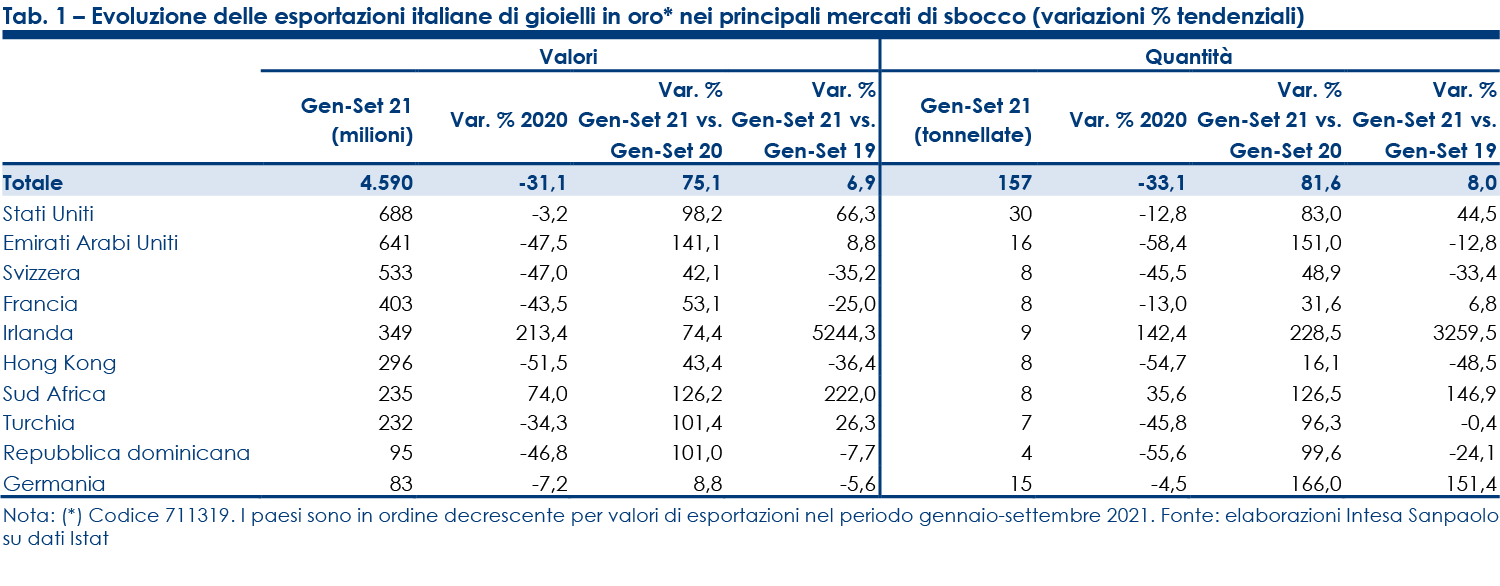

Nel 2020, l’epidemia di Covid-19 ha interrotto le catene di approvvigionamento globali e aumentato la domanda di beni rifugio. Nel 2021, il mercato globale dell’oro dovrebbe beneficiare di un rimbalzo della domanda di gioielli e di un contesto macroeconomico favorevole tra politiche monetarie espansive, tassi di interesse bassi e un aumento delle aspettative di inflazione.

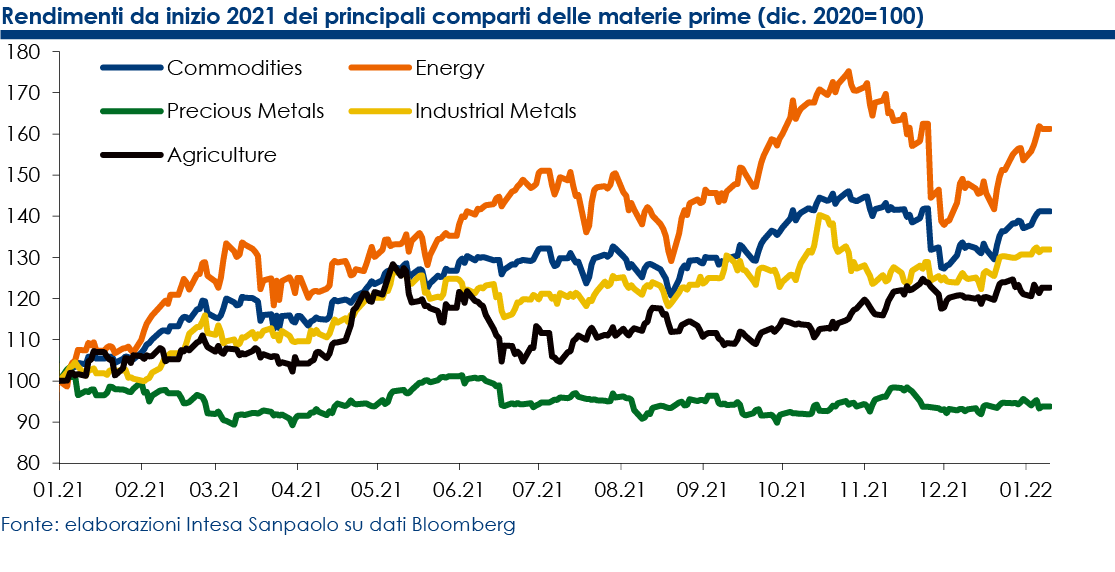

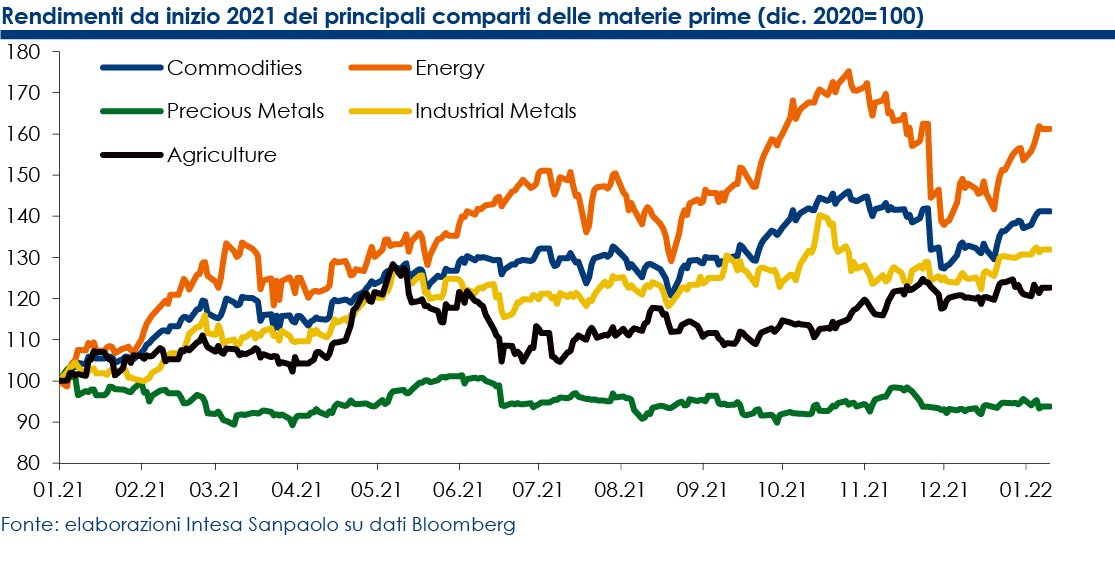

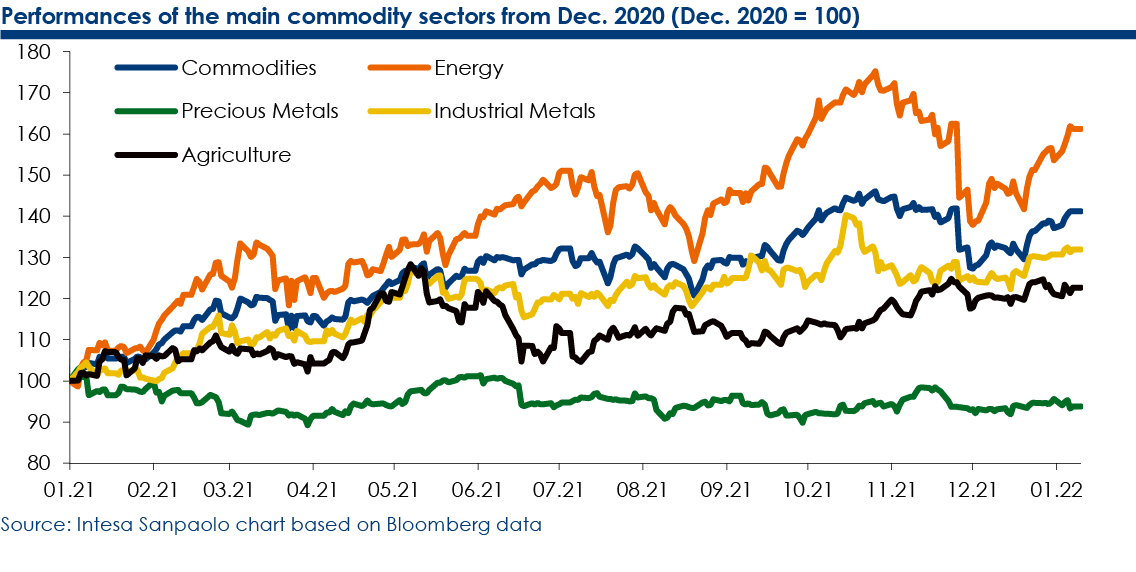

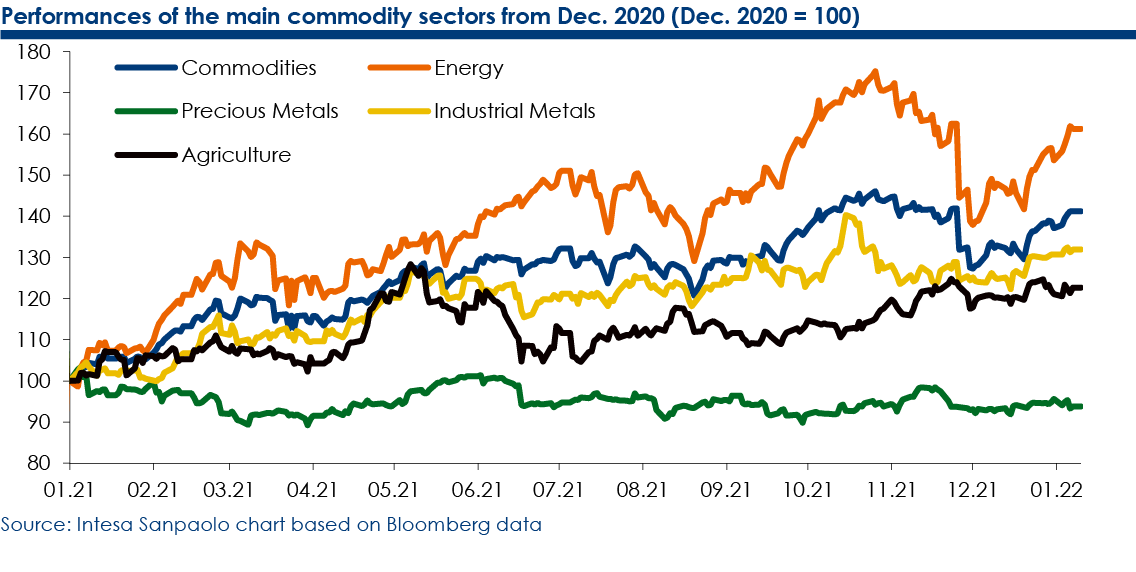

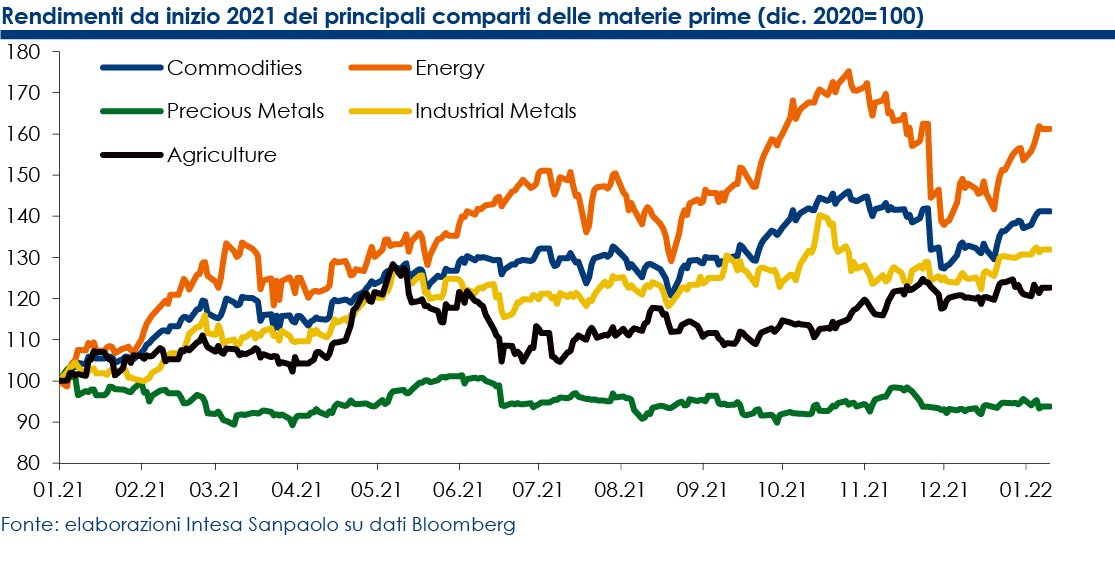

Materie prime: pesano la variante Omicron e le politiche monetarie

L’impatto negativo della variante Omicron e la minaccia di politiche monetarie più restrittive rappresentano ora i principali ostacoli per i mercati delle materie prime e potrebbero innescare più ampie correzioni dei prezzi nel breve termine. Tuttavia, un temporaneo indebolimento dei corsi delle materie prime favorirebbe l’economia mondiale, contribuendo ad accelerare i tassi di crescita, e semplificherebbe il compito delle principali banche centrali, che potrebbero continuare a sostenere la ripresa economica invece di combattere le pressioni inflazionistiche.

Le prospettive macroeconomiche si confermano più deboli di quanto inizialmente previsto, a causa delle elevate pressioni inflazionistiche e dei timori di una stretta monetaria più rapida di quanto precedentemente anticipato da parte della Federal Reserve. Inoltre, l’inattesa diffusione della variante Omicron ha provocato una revisione al ribasso delle stime di domanda mondiale di materie prime, ritardando ulteriormente la ripresa in alcuni settori, come l’aviazione, o causando un peggioramento delle prospettive per le filiere globali a causa della persistente minaccia di colli di bottiglia logistici e chiusure temporanee delle attività economiche e produttive.

A nostro avviso, in questo momento l’impatto negativo della variante Omicron e la minaccia di politiche monetarie più restrittive rappresentano i principali ostacoli per i mercati delle materie prime e potrebbero innescare più ampie correzioni dei prezzi di mercato nel breve termine.

Tuttavia, un temporaneo indebolimento dei corsi delle materie prime addurrebbe grandi benefici all’economia mondiale, contribuendo ad accelerare i tassi di crescita, e semplificherebbe il compito delle principali banche centrali, che potrebbero continuare a sostenere la ripresa economica invece di combattere le pressioni inflazionistiche alimentate dalle materie prime.

Nel nostro scenario di base, dopo una probabile, più profonda, correzione a inizio anno, i prezzi della maggior parte delle materie prime potrebbero riprendere una traiettoria di moderato rialzo. Infatti, le quotazioni di petrolio e metalli non ferrosi potrebbero recuperare parte del terreno perso non appena le banche centrali avranno rassicurato i mercati e la crescita economica globale si sarà consolidata

Nel 2022, gli specifici fondamentali di domanda e offerta dovrebbero ritornare ad essere i principali driver dei prezzi delle materie prime, prevalendo sui fattori macroeconomici, e la volatilità dovrebbe essere alimentata soprattutto da flussi di notizie riguardanti interruzioni delle forniture, ritardi nelle filiere logistiche e previsioni sulle future dinamiche di consumo, soprattutto in Cina.

Nel medio e lungo termine, continuiamo ad attenderci un trend rialzista per i metalli industriali, mentre i prezzi di gas naturale ed energia dovrebbero registrare una progressiva diminuzione, pur mantenendo le consuete oscillazioni stagionali.

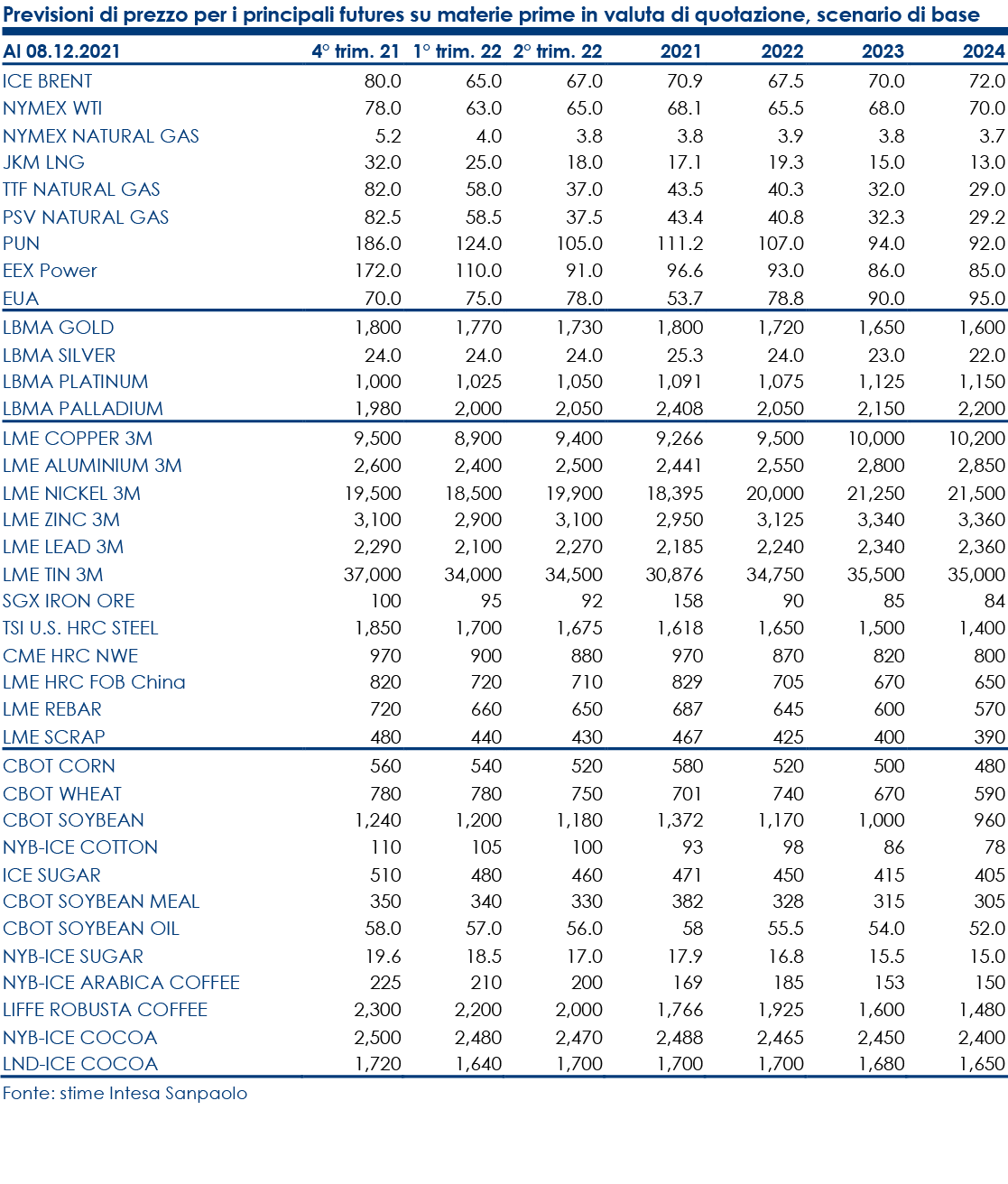

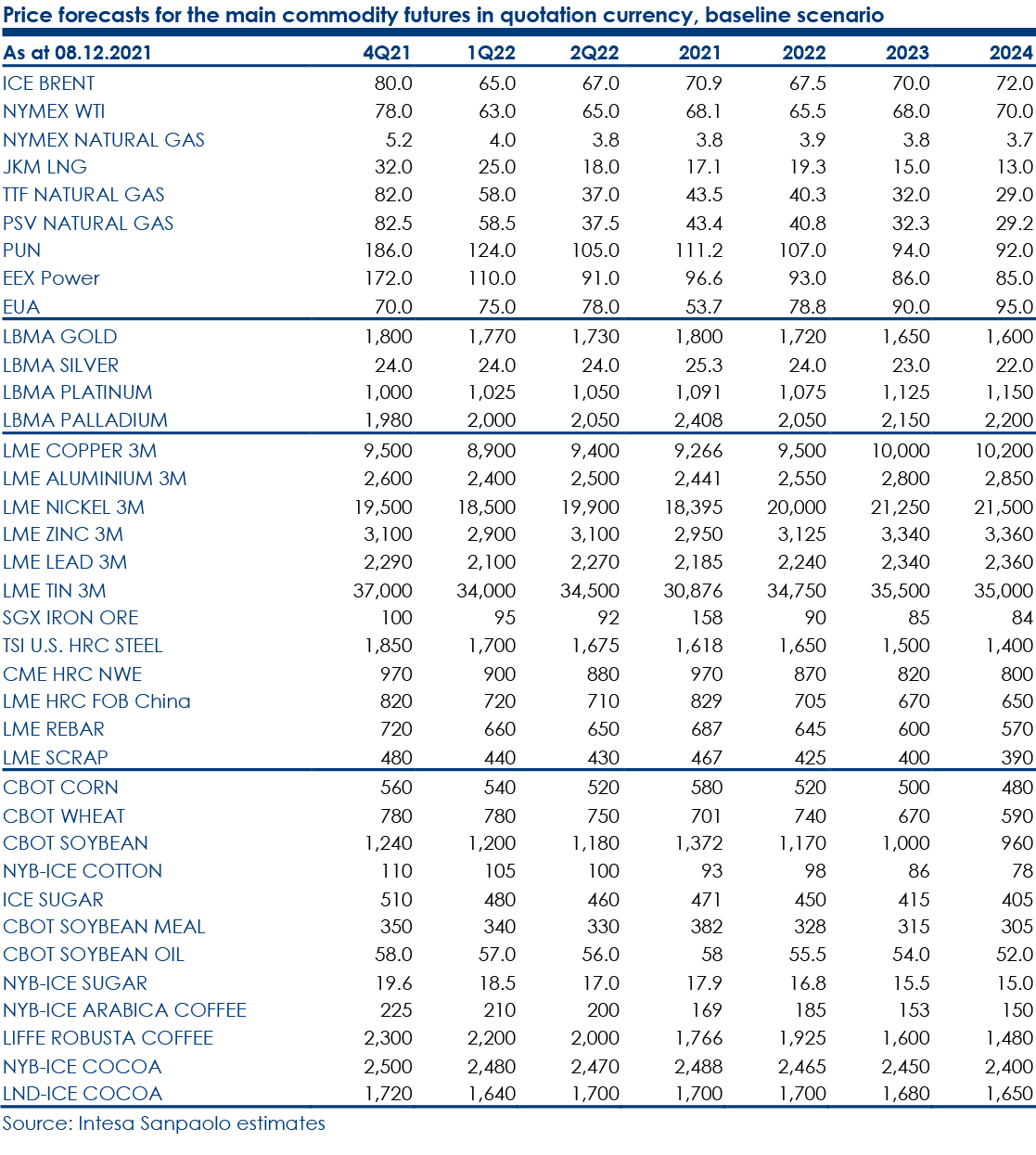

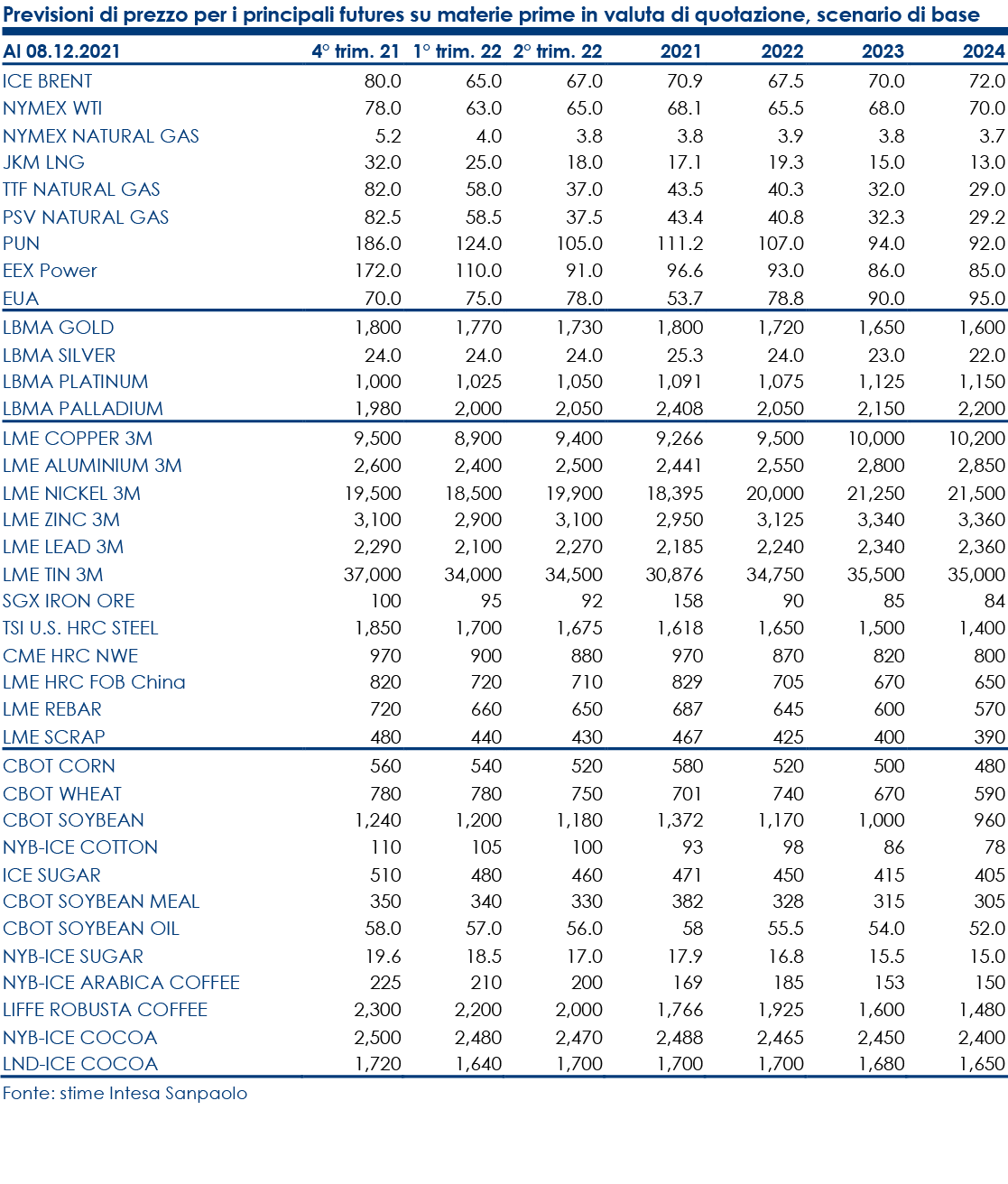

Previsioni per l’universo delle materie prime

Petrolio. A seguito del recente indebolimento dei fondamentali di domanda e offerta e dei timori di una più rapida stretta monetaria, abbiamo rivisto al ribasso le nostre stime sulle quotazioni del petrolio nel 2022. A nostro avviso, una temporanea correzione potrebbe spingere il Brent verso un livello medio di 65 dollari nel 1° trimestre 2022. Successivamente, le pressioni al rialzo sul prezzo del petrolio potrebbero riprendere forza a fronte di previsioni più ottimistiche sulla domanda mondiale, grazie a un aumento stagionale dei consumi di combustibili e, si spera, di un allentamento dei timori sull’andamento dell’epidemia. Di conseguenza, ci attendiamo che si consolidi un trend rialzista del prezzo del petrolio a partire dal 2° trimestre 2022. Nel nostro scenario di base, prevediamo una quotazione media per il Brent di 67,5 dollari nel 2022 e di 70 dollari nel 2023. La volatilità dovrebbe rimanere una importante caratteristica di mercato e contribuirà spesso ad amplificare movimenti intraday.

Mercati energetici. Anche se difficilmente potranno ripetersi ogni anno le condizioni estreme che hanno caratterizzato i mercati mondiali di gas ed energia alle porte della stagione invernale 2021/22, possiamo comunque attenderci più frequenti periodi di stress di mercato e una maggiore volatilità dei prezzi dell’energia, dovuti alla necessaria e inevitabile transizione verso fonti energetiche più pulite e alla progressiva penetrazione delle energie rinnovabili.

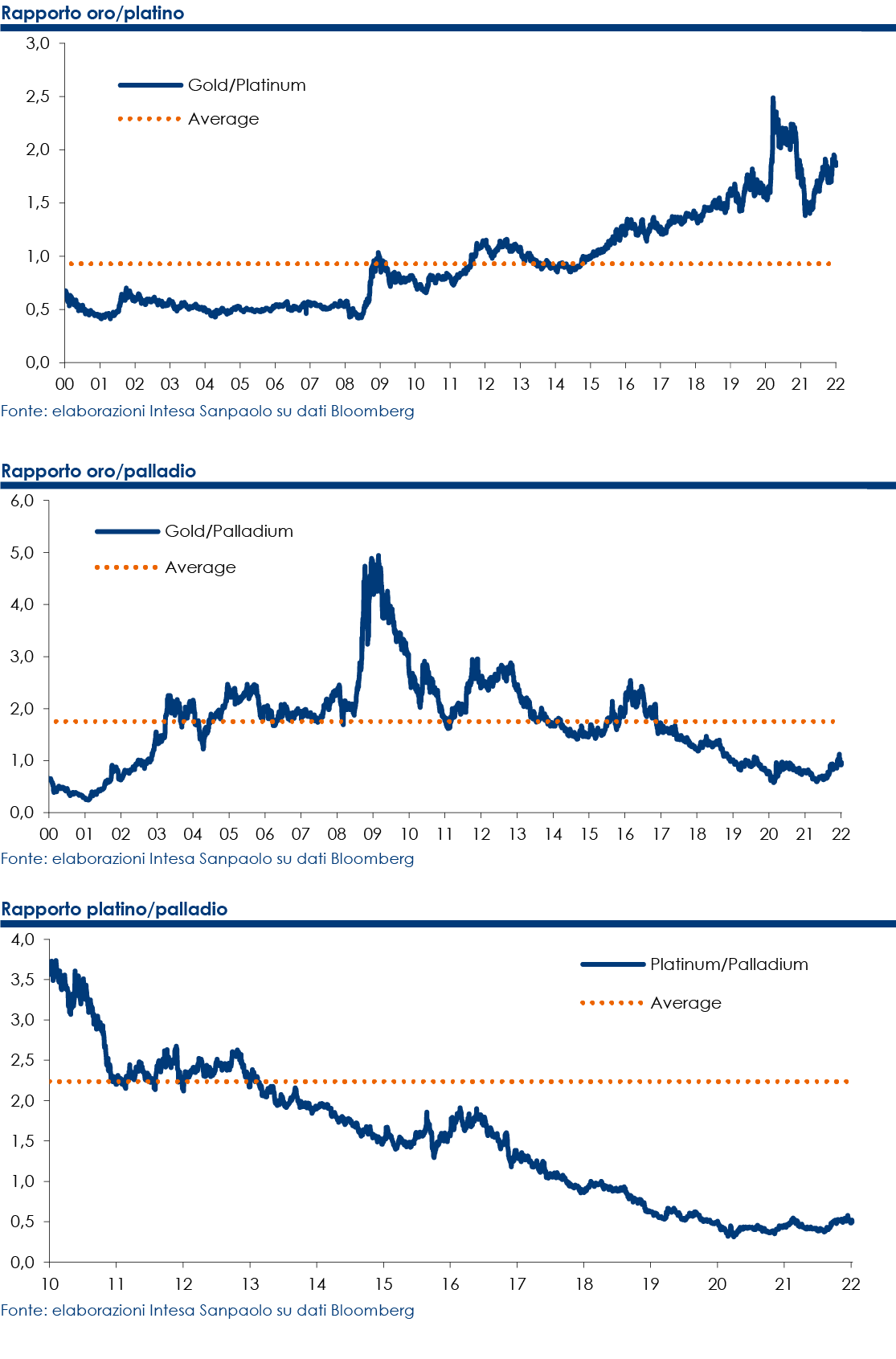

Metalli preziosi. Nel 2021, le quotazioni di tutti i principali metalli preziosi hanno registrato una flessione. Manteniamo una view negativa su oro e argento, poiché riteniamo che l’adozione di politiche monetarie più restrittive continuerà a ridurre la propensione a investire nei due metalli. Per contro, ci attendiamo un parziale recupero delle recenti perdite subite da platino e palladio, grazie alla probabile accelerazione della domanda proveniente dal settore automobilistico, dovuta all’allentamento della crisi dei semiconduttori.

Metalli industriali. L’inattesa diffusione della variante Omicron e le aspettative di una più rapida stretta da parte della Federal Reserve hanno determinato un aumento del rischio di una più marcata correzione dei prezzi di gran parte dei metalli industriali. Ora, prevediamo infatti una diminuzione delle quotazioni nel 1° trimestre 2022. Tuttavia, più avanti nel corso del 2022, gli specifici fondamentali di domanda e offerta dovrebbero tornare ad essere i principali driver e quindi le quotazioni dei metalli non ferrosi dovrebbero recuperare terreno. Nel medio/lungo termine, continuiamo ad attenderci un trend rialzista per i metalli industriali.

Merci agricole. L’agricoltura è il settore delle materie prime che esibisce la più marcata elasticità dell’offerta ai prezzi. Di conseguenza, le elevate quotazioni registrate nel 2021 dovrebbero contribuire ad aumentare l’offerta nel 2022, laddove possibile, e potrebbero determinare diffuse diminuzioni dei prezzi in anticipazione della prossima stagione dei raccolti. Tuttavia, anomale condizioni meteorologiche restano la minaccia più preoccupante e potrebbero alimentare volatilità, a causa degli impatti più gravi e meno prevedibili del cambiamento climatico e del riscaldamento globale sul settore.

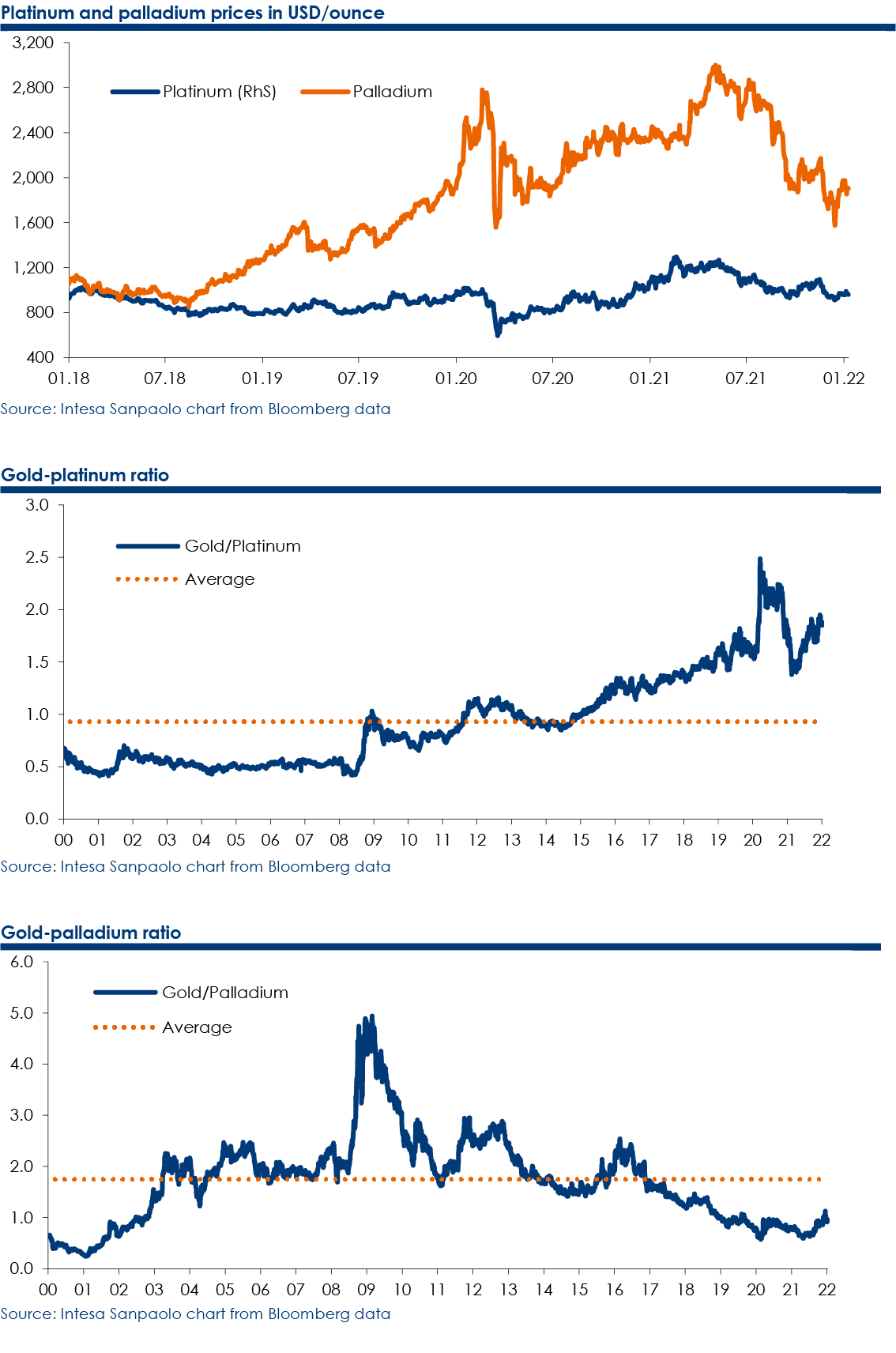

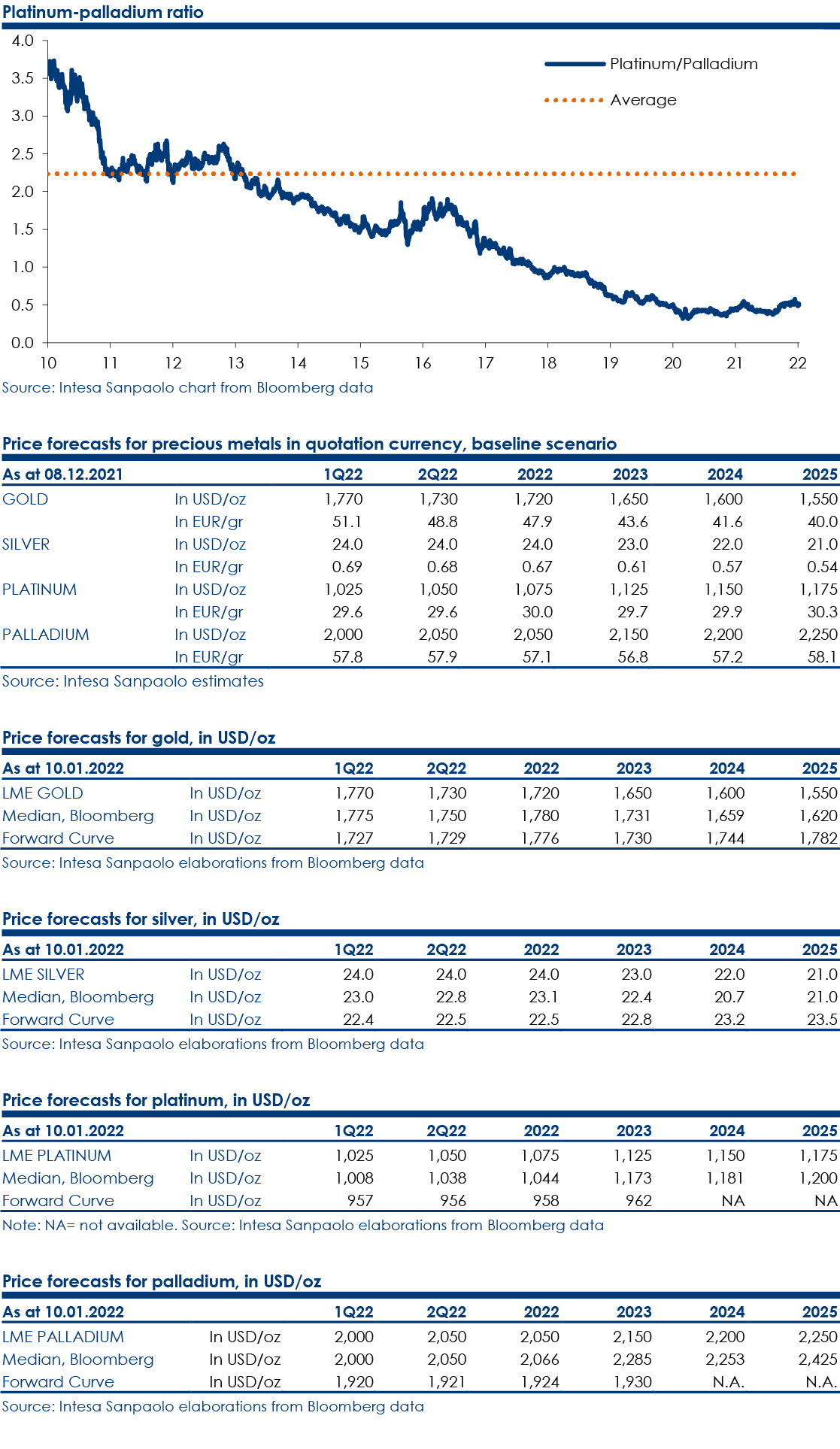

Metalli preziosi: preferiamo il palladio all’oro

Nel 2021, le quotazioni dei metalli preziosi hanno registrato una flessione. Manteniamo una view negativa su oro e argento, poiché l’adozione di politiche monetarie più restrittive dovrebbe ridurre la propensione a investire nei due metalli. Per contro, ci attendiamo un parziale recupero di platino e palladio, grazie alla probabile accelerazione della domanda dal settore automobilistico. Pertanto, nell’ambito di un’asset allocation strategica a medio termine, preferiamo il palladio all’oro.

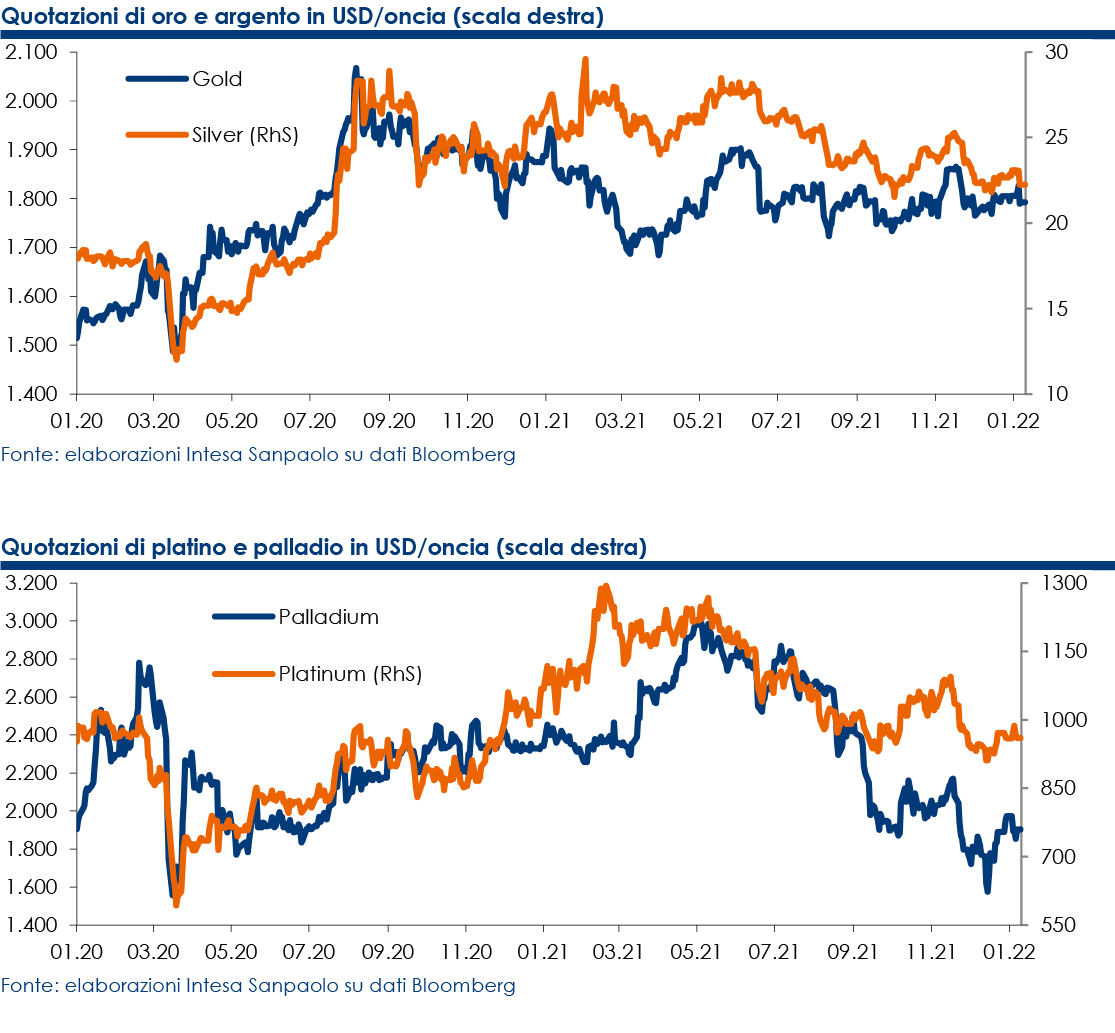

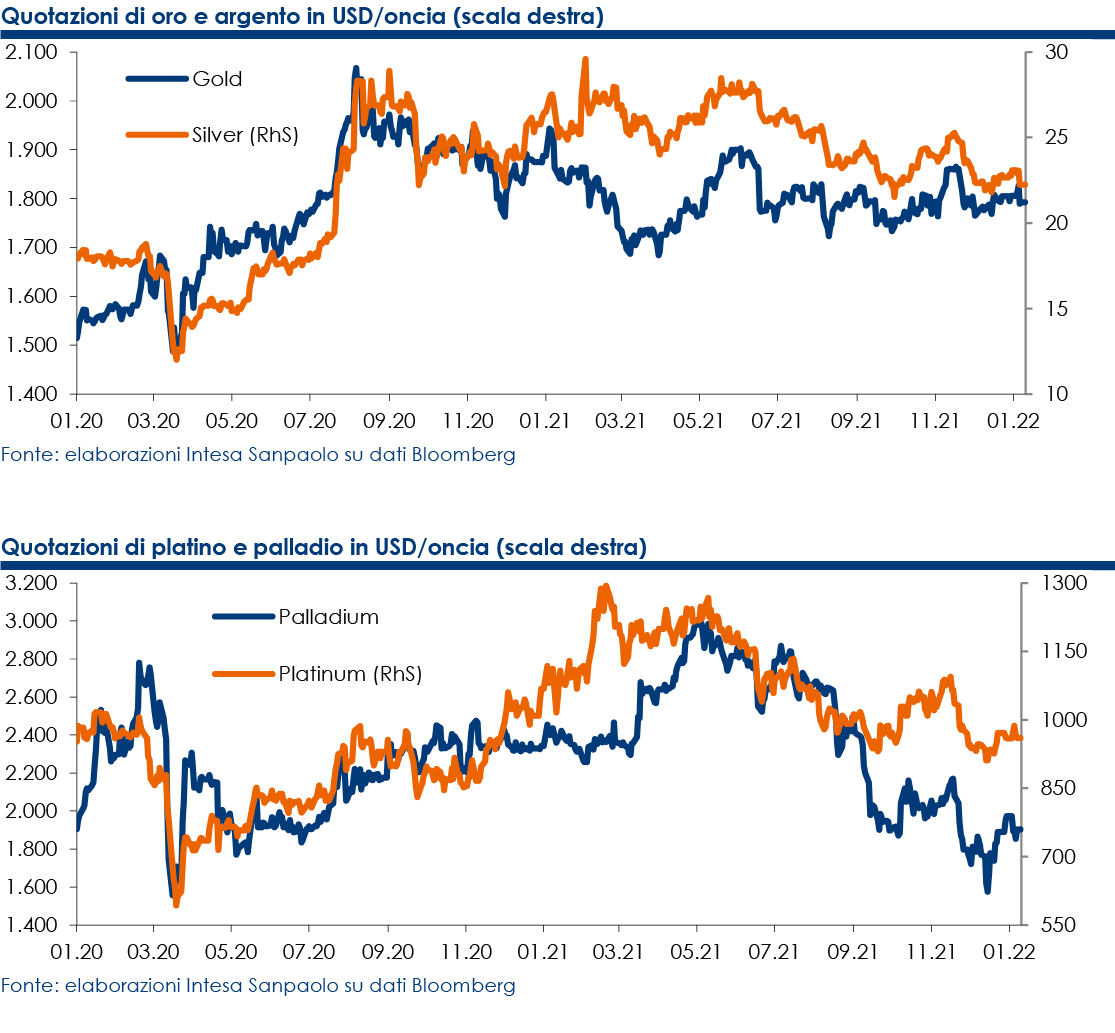

Nel 2021, le quotazioni di tutti i principali metalli preziosi hanno registrato una flessione. Oro e argento hanno subito pressioni al ribasso dovute al rafforzamento del dollaro americano e agli annunci di un’anticipazione della stretta monetaria da parte delle principali banche centrali. In effetti, le aspettative di un rialzo dei tassi scoraggiano gli investimenti in oro e altri asset infruttiferi, poiché ne determinano un aumento del costo opportunità. Manteniamo una view negativa su entrambi i metalli, poiché riteniamo che l’ostacolo rappresentato dall’attesa stretta monetaria continuerà a ridurre la propensione a investire in oro sui mercati finanziari. Attualmente, riteniamo che l’argento non sia abbastanza forte per potersi decorrelare dall’oro, nonostante i promettenti fondamentali a lungo termine.

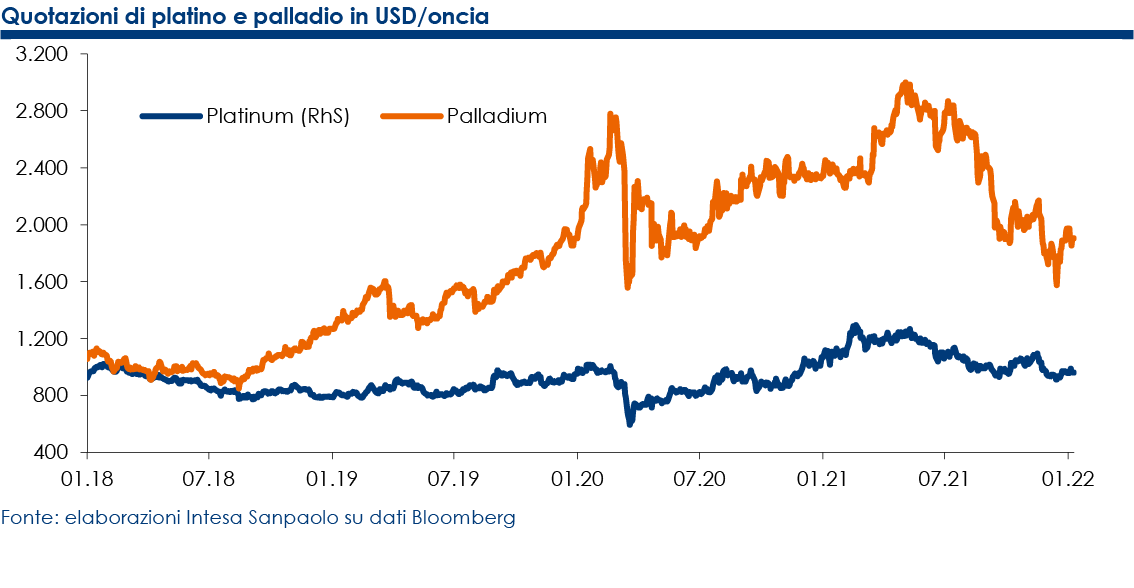

Nel 2° semestre, anche le quotazioni di platino e palladio hanno subito una diminuzione, poiché la scarsità di semiconduttori ha avuto un impatto negativo più grave del previsto sulla produzione di autoveicoli e, di conseguenza, sul consumo di entrambi i metalli. Probabilmente i prezzi hanno toccato i minimi e attualmente ci attendiamo un parziale recupero delle recenti perdite subite, complice la probabile accelerazione della domanda dal settore automobilistico dovuta al graduale allentamento della crisi dei semiconduttori.

Nel nostro scenario di base, prevediamo un consolidamento della crescita globale e un graduale allentamento dei colli di bottiglia e della crisi dei semiconduttori. Le politiche monetarie dovrebbero subire una stretta, pur continuando a sostenere la ripresa dell’economia mondiale sinché necessario. Pertanto, nell’ambito di un’asset allocation strategica a medio termine, preferiamo il palladio all’oro.

Oro

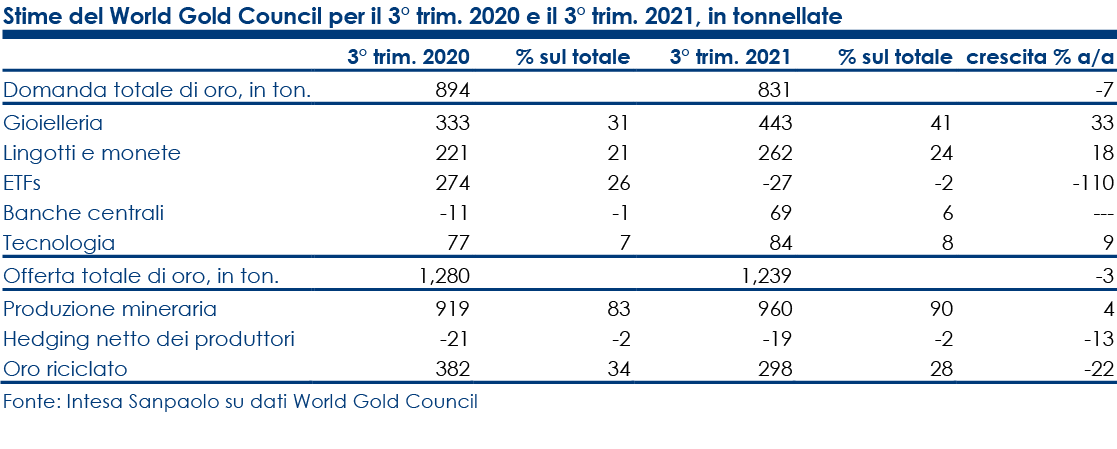

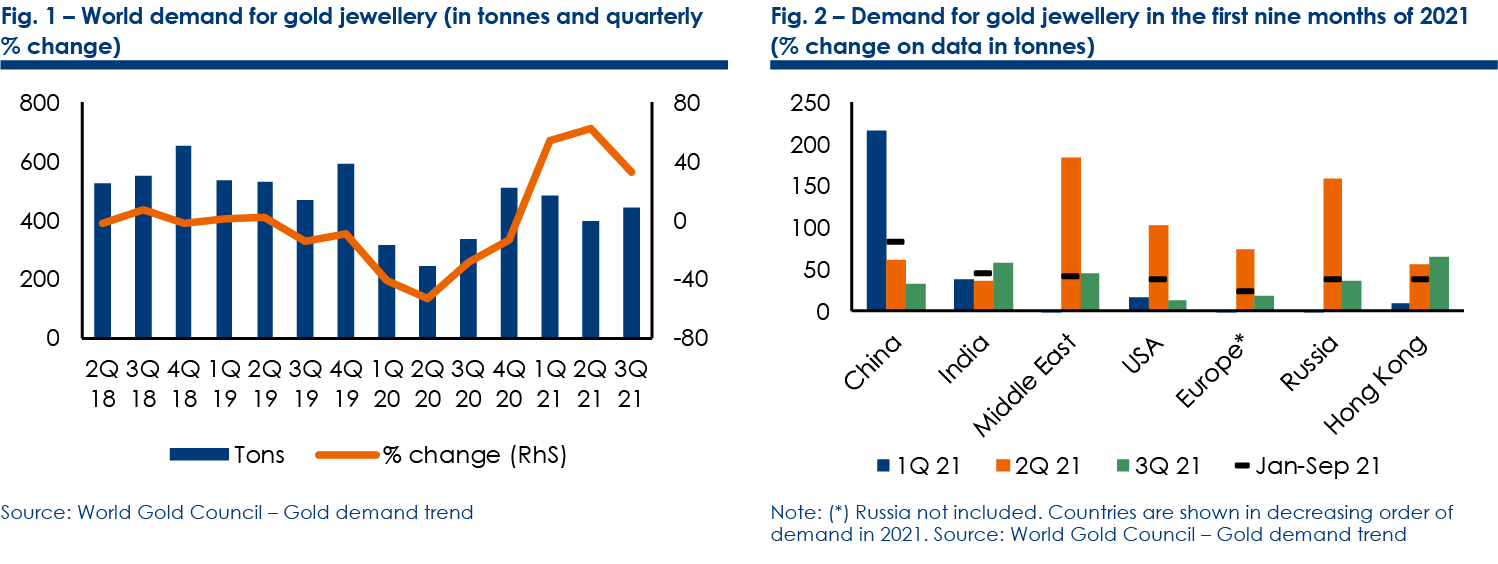

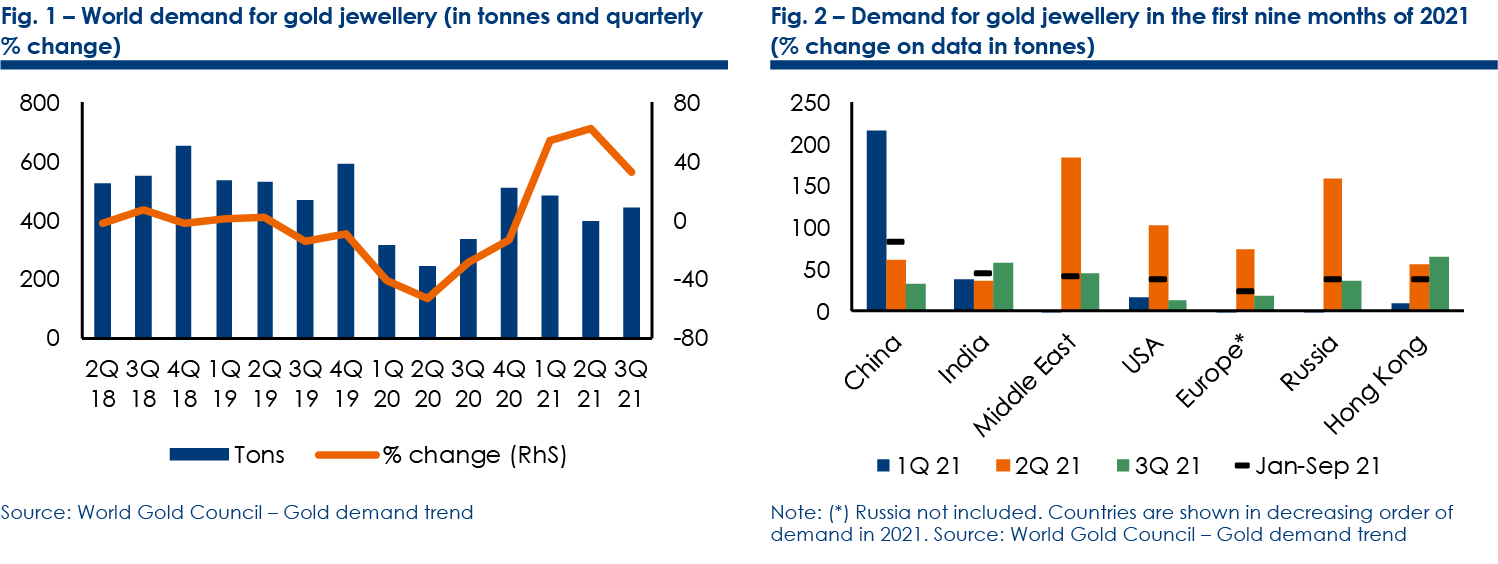

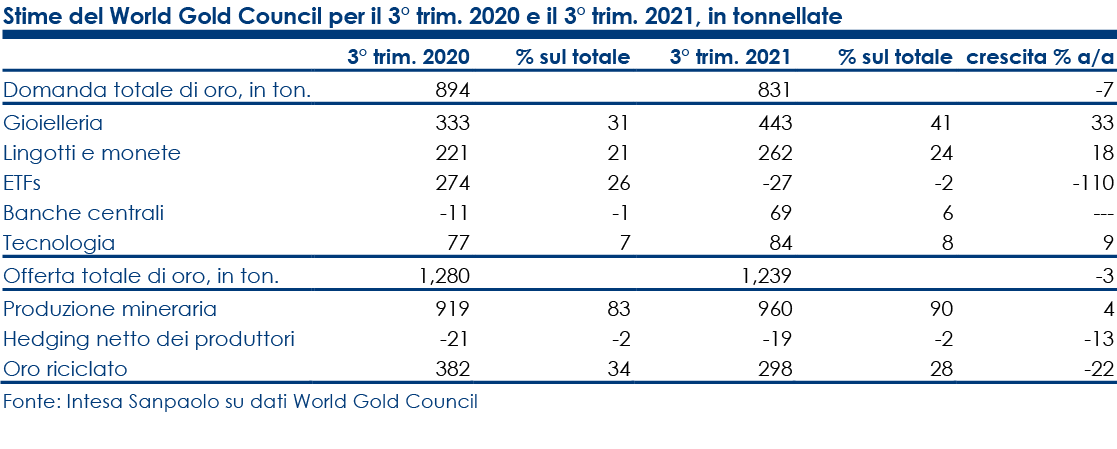

Secondo gli ultimi dati pubblicati dal World Gold Council (WGC), nel 3° trimestre 2021 i mercati finanziari hanno ulteriormente perso appetito per l’oro a causa dell’attesa di adozione di politiche monetarie più restrittive e del dibattito riguardo l’avvio del tapering da parte della Fed.

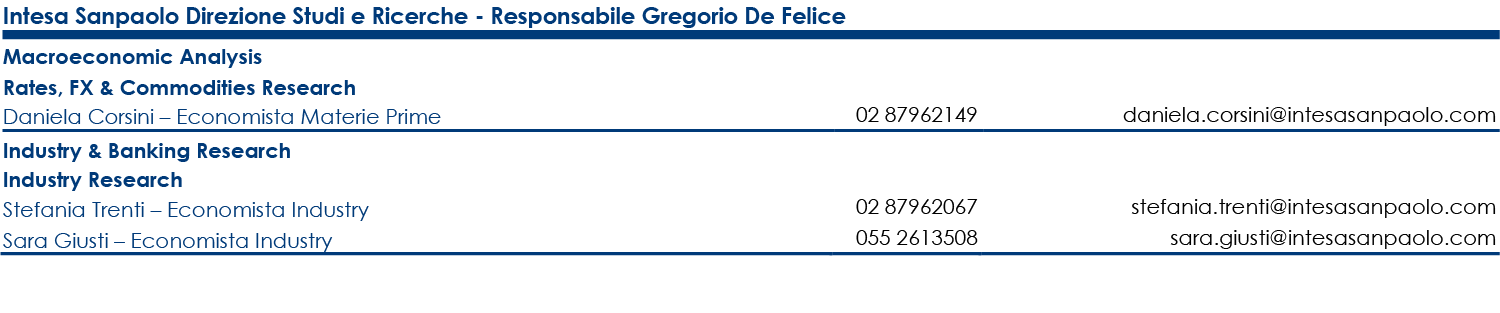

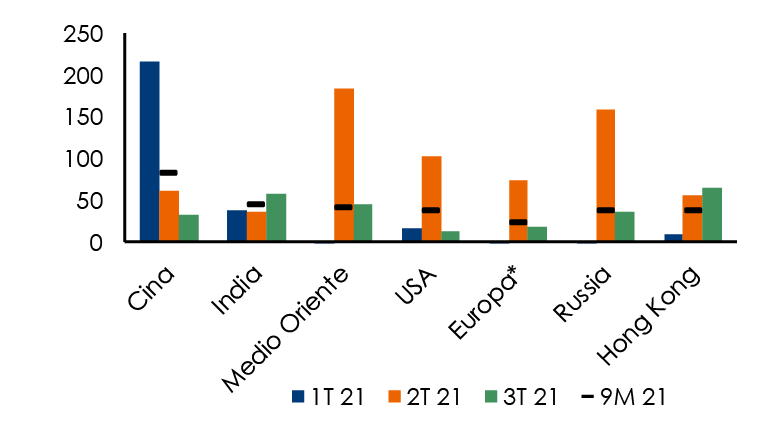

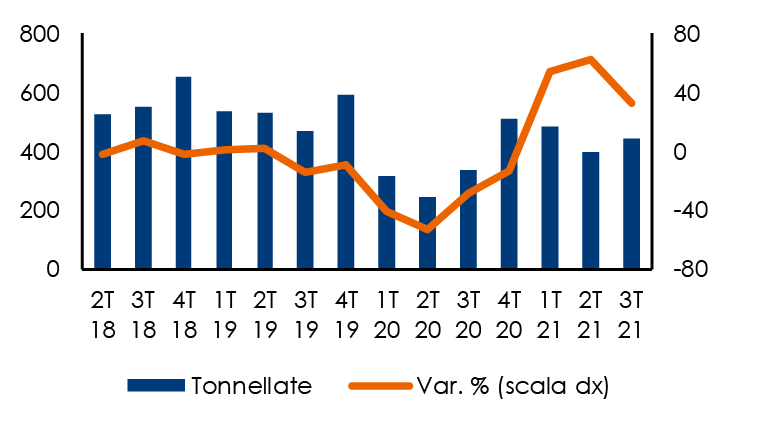

Considerando i volumi di oro detenuti da ETF come proxy dell’appetito dei mercati finanziari per il metallo giallo, a fine settembre le posizioni totali detenuti da ETF erano vicine alle 3.600 tonnellate, poiché il comparto aveva registrato disinvestimenti pari a circa 156 tonnellate da inizio anno, la diminuzione più forte dal 2013. Nel solo 3° trimestre 2021, le posizioni in oro detenute da ETF sono diminuite di circa 27 tonnellate. Di conseguenza, nel trimestre questi fondi hanno fornito un contributo negativo alla domanda di oro, rappresentando una perdita netta pari al 2% circa della domanda globale. Si tratta di un cambiamento significativo del sentiment di mercato, considerando che i flussi degli ETF avevano fornito un contributo positivo pari al 4% circa del consumo globale nel 2° trimestre 2021 e avevano rappresentato ben il 40% della domanda mondiale nel 2° trimestre 2020, una percentuale senza precedenti.

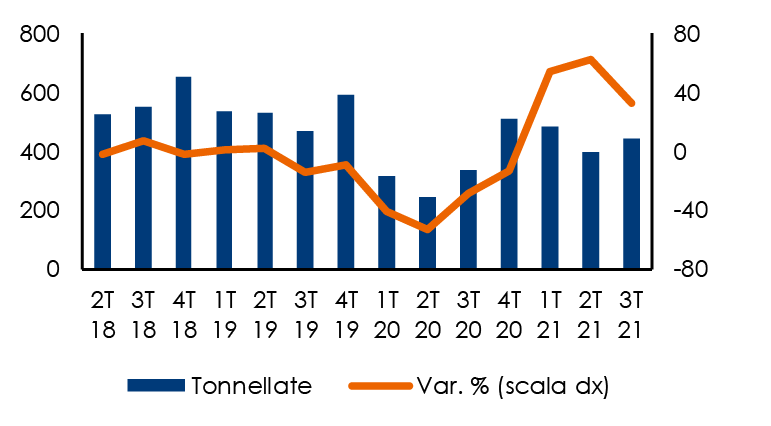

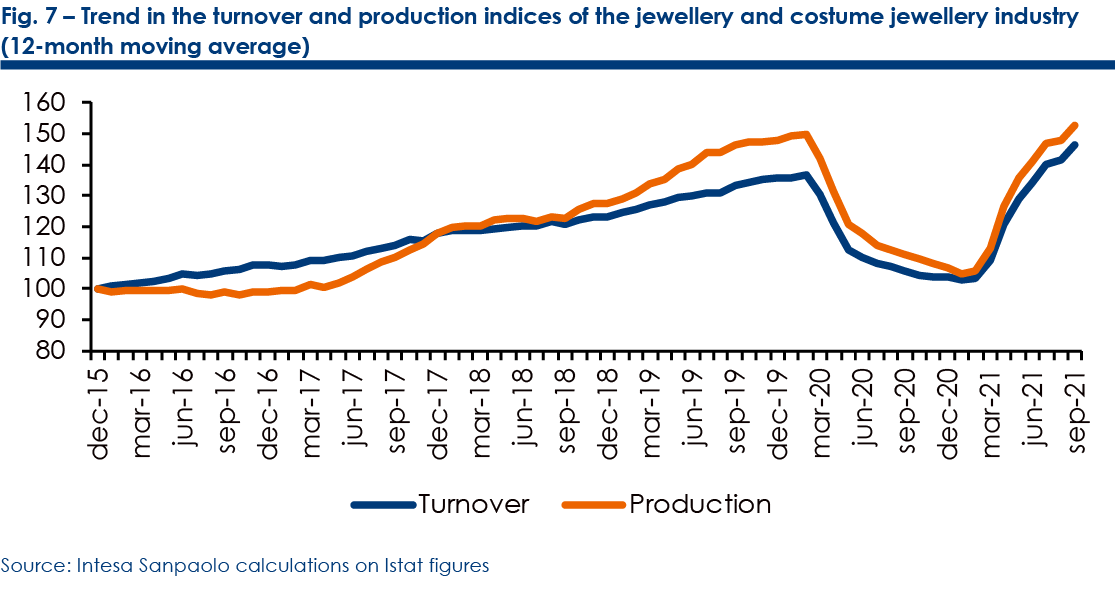

Considerando la rilevanza dei flussi in oro da ETF, nel 3° trimestre 2021 la domanda mondiale di metallo prezioso ha subito una contrazione del 7% a/a, nonostante tutte le componenti non finanziarie siano aumentate. Infatti, la ripresa della crescita economica mondiale ha spinto al rialzo il consumo di oro nei settori gioielleria (+33% a/a) e tecnologia (+7% a/a), mentre i maggiori tassi di risparmio, i timori sui rischi di inflazione e l’incertezza sull’andamento dell’epidemia di coronavirus hanno alimentato la domanda di lingotti e monete (+18% a/a). Nel settore ufficiale, la domanda è stata sostenuta dal rinnovato interesse per la diversificazione delle riserve ufficiali. Infatti, le banche centrali sono passate dall’essere venditrici nette di oro nel 3° trimestre 2020 ad acquirenti nette di metallo nel 3° trimestre 2021.

Considerando le attese di politiche monetarie più restrittive e di una crescita globale ancora solida, nei prossimi trimestri le componenti non finanziarie della domanda di oro potrebbero rafforzare la loro ripresa, e prevediamo un incremento degli acquisti in gioielleria, tecnologia e nel settore ufficiale. Per contro, gli ETF aventi oro fisico come sottostante potrebbero essere penalizzati da maggiori disinvestimenti dovuti all’aumento del costo opportunità legato al possesso del metallo giallo, a fronte di aspettative di un rialzo dei rendimenti e dei rischi di rialzo dei tassi di interesse di riferimento.

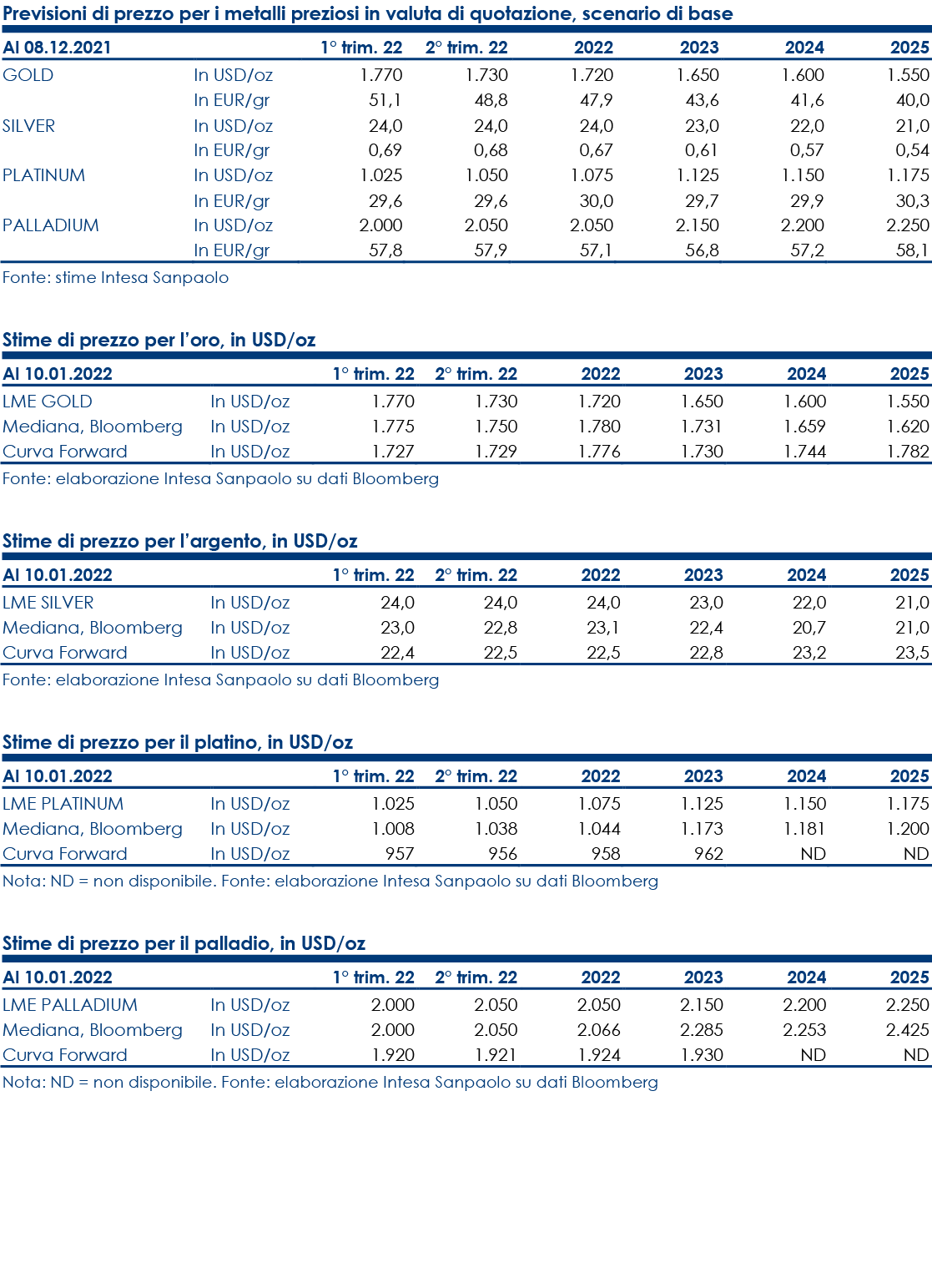

Nel nostro modello di base, prevediamo una quotazione media per l’oro di circa 1.770 dollari nel 1° trimestre 2022 e una possibile diminuzione intorno a una media di 1.720 dollari nel 2022. Nonostante lo scenario monetario sfavorevole, ci attendiamo solo moderate pressioni al ribasso sulle quotazioni dell’oro, grazie al forte sostegno fornito dalla ripresa in atto nel settore della gioielleria, favorita dalla crescita economica, e dal settore ufficiale, poiché le banche centrali potrebbero sfruttare il calo delle quotazioni per diversificare le proprie riserve. Inoltre, i timori relativi all’inflazione potrebbero frenare i disinvestimenti dagli ETF.

A causa della forte incertezza che grava sullo scenario macroeconomico per l’impossibilità di prevedere l’andamento dei rischi epidemiologici, i prezzi record dell’energia e i persistenti colli di bottiglia che penalizzano le filiere logistiche e le attività manifatturiere, le nostre previsioni rimangono esposte a rischi significativi.

Per l’oro, lo scenario più pessimistico sarebbe quello di un contesto macroeconomico caratterizzato da un’ulteriore accelerazione della crescita mondiale favorita da un’attenuazione dei timori epidemiologici, dall’allentamento dei colli di bottiglia e da un forte impegno delle banche centrali a intervenire per impedire il surriscaldamento dell’economia. Infatti, in questo scenario gli investitori accorderebbero la loro preferenza agli asset ciclici piuttosto che ai beni rifugio e l’aumento dei tassi di interesse scoraggerebbe gli investimenti in oro. In questo scenario, le quotazioni del metallo potrebbero scendere rapidamente in prossimità di un supporto di 1.450 dollari.

Per contro, lo scenario più ottimistico per l’oro sarebbe quello di un contesto macroeconomico caratterizzato dal peggioramento delle prospettive di crescita globale, complici una diffusione incontrollata dell’epidemia e vaccini poco efficaci. Le banche centrali sarebbero quindi costrette a rinviare la stretta monetaria pianificata nel tentativo di sostenere le rispettive economie, mentre i colli di bottiglia delle filiere logistiche e produttive permarrebbero, alimentando le pressioni inflazionistiche. In questo scenario estremo di stagflazione, l’oro potrebbe ritestare i suoi massimi al di sopra dei 2.000 dollari.

Argento

Nel nostro modello di base, prevediamo un prezzo medio per l’argento di circa 24 dollari l’oncia sia per il 1° trimestre 2022 che per l’intero anno. Ci attendiamo che il metallo scambi per la maggior parte del tempo all’interno di un intervallo compreso tra 21 e 27 dollari l’oncia.

Rispetto all’oro, l’argento dovrebbe mantenersi più volatile, ma probabilmente non sarà abbastanza forte per potersi decorrelare dal metallo giallo. Di conseguenza, nei prossimi anni l’argento appare destinato a seguire il trend ribassista dell’oro, nonostante i fondamentali positivi e le previsioni di aumento della domanda globale, soprattutto nel settore delle tecnologie verdi.

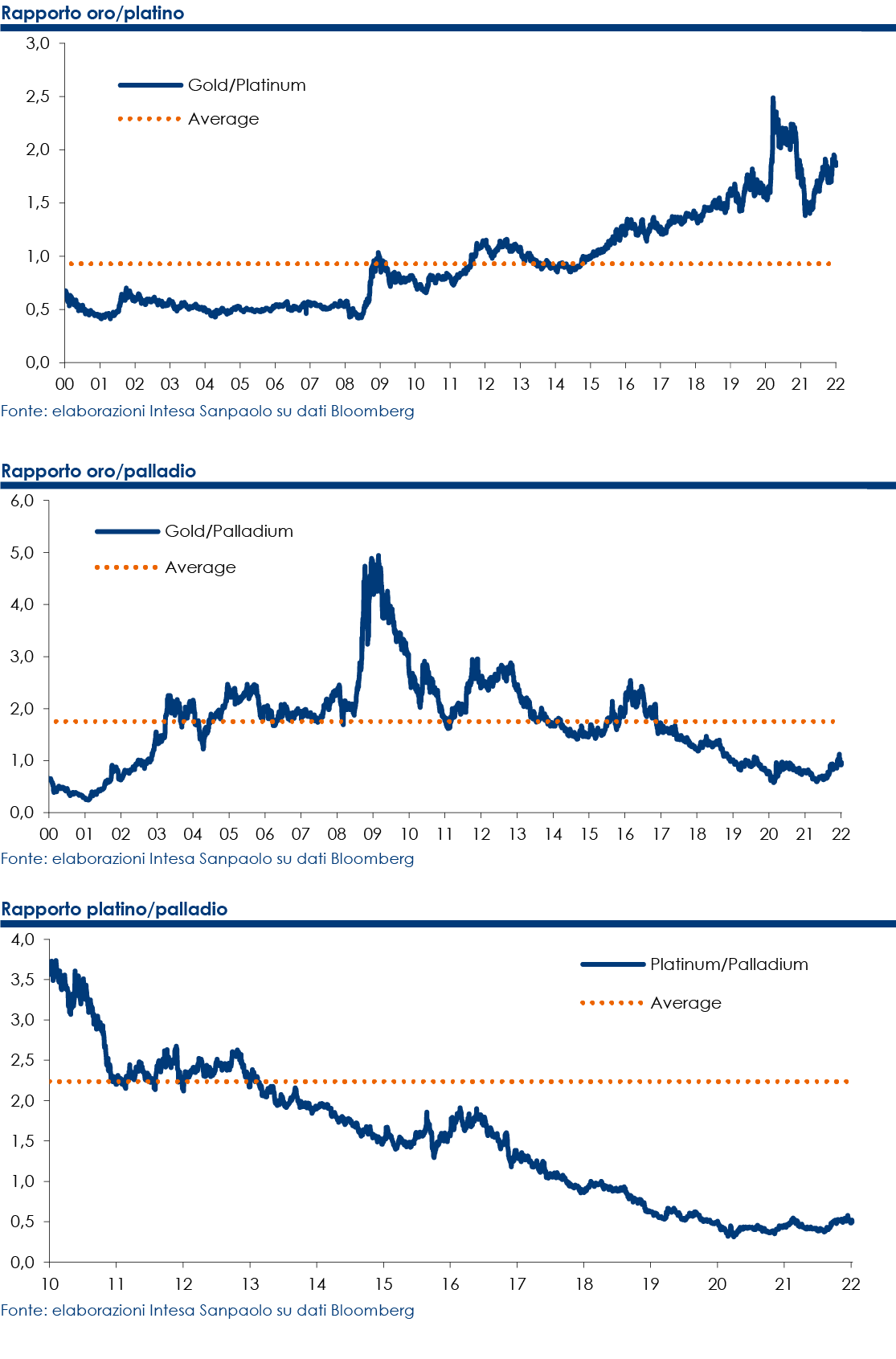

Per i prossimi anni, ci attendiamo un rapporto tra oro e argento ancora leggermente superiore alla media di lungo periodo, data la ancora forte correlazione positiva di lungo termine tra i due metalli, nonostante il supporto fornito all’argento dalla transizione verde.

Platino e palladio

Le nostre previsioni sui metalli del gruppo del platino (PGM) sono strettamente connesse alle aspettative di una ripresa nel settore automobilistico e, di conseguenza, agli sviluppi della crisi dei semiconduttori. Infatti, secondo le stime di Johnson Matthey, l’85% circa della domanda di palladio proviene dalle marmitte catalitiche utilizzate per lo più nei veicoli dotati di motori a benzina, mentre oltre il 30% della domanda di platino proviene dalle marmitte catalitiche utilizzate per lo più nei veicoli dotati di motori diesel.

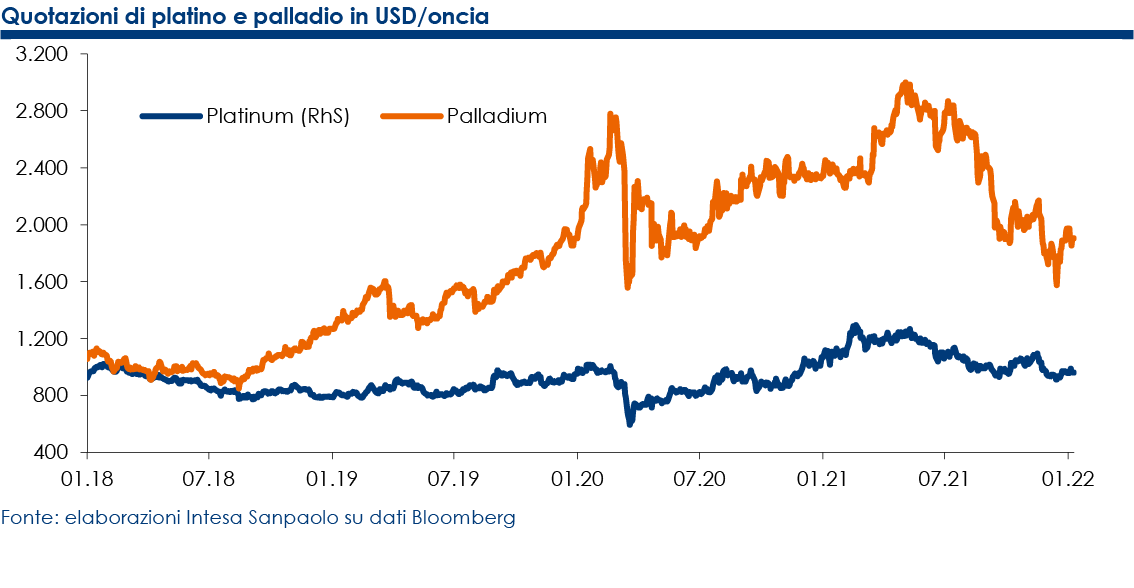

Nel 2021, i PGM hanno registrato un ciclo di espansione e crisi. In effetti, nel primo semestre platino e palladio hanno sovraperformato gli altri metalli preziosi, poiché i produttori di autoveicoli hanno rapidamente incrementato gli acquisti per rifornire i magazzini e soddisfare i nuovi ordinativi, nonostante i primi segnali di rallentamenti lungo le filiere produttive dovuti alla carenza di semiconduttori.

Successivamente, con il passare del tempo e il consolidamento della ripresa mondiale, la scarsità di semiconduttori si è aggravata, costringendo i produttori di autoveicoli a rivedere al ribasso i piani di produzione e, in alcuni casi, a bloccare alcuni stabilimenti produttivi. Di conseguenza, la domanda di PGM si è drasticamente ridotta. Diversi produttori hanno rivisto al ribasso le proprie previsioni di output, alimentando il pessimismo sui mercati finanziari e dubbi sulla futura crescita di consumi di platino e palladio nel settore.

Attualmente, i produttori di autoveicoli sono probabilmente ben forniti per soddisfare le loro esigenze di PGM a medio termine. Di conseguenza, finora i bassi prezzi non hanno attirato i consumatori, a causa delle stime ancora incerte sulla produzione futura. Più a lungo termine, nonostante ci sia ancora spazio per un aumento dei prezzi, probabilmente il potenziale di rialzo dei PGM è stato strutturalmente ridotto dalla crisi dei semiconduttori, poiché gli attuali ritardi nelle dinamiche di consumo dei PGM implicano che l’offerta beneficerà di più tempo per poter soddisfare la domanda e che l’offerta secondaria beneficerà di più tempo per tornare a fluire sul mercato, grazie a una ripresa delle attività di riciclo.

Nel nostro scenario di base, per il 1° trimestre 2022 ipotizziamo un prezzo medio per il platino e il palladio rispettivamente di 1.025 dollari l’oncia e di 2.000 dollari l’oncia. Secondo le nostre previsioni, nel 2022 le quotazioni potrebbero raggiungere un livello medio vicino a 1.075 dollari per il platino e 2.050 dollari per il palladio.

A nostro avviso, il palladio potrebbe aver toccato i minimi, poiché la soglia di 1.700 dollari dovrebbe rappresentare un forte supporto per il metallo. Per contro, il minimo di 950 dollari raggiunto a novembre è un debole supporto per il platino e riteniamo che il livello di 900 dollari costituisca un più solido livello minimo.

Manteniamo una view rialzista a lungo termine (nonostante la revisione al ribasso delle previsioni rispetto al mese di giugno dovuta ai disagi più gravi e prolungati del previsto lungo la filiera), poiché ci attendiamo un possibile miglioramento della crisi dei semiconduttori nel 2022, grazie ai piani per ampliare la produzione di microchip a livello mondiale, e quindi prevediamo una ripresa sia della produzione di autoveicoli che della domanda globale di PGM.

Appendice

Certificazione degli analisti

Gli analisti finanziari che hanno predisposto la presente ricerca, i cui nomi e ruoli sono riportati nella prima pagina del documento dichiarano che:

(1) Le opinioni espresse sulle società citate nel documento riflettono accuratamente l’opinione personale, indipendente, equa ed equilibrata degli analisti;

(2) Non è stato e non verrà ricevuto alcun compenso diretto o indiretto in cambio delle opinioni espresse.

Comunicazioni specifiche

Gli analisti citati non ricevono, stipendi o qualsiasi altra forma di compensazione basata su specifiche operazioni di investment banking.

Comunicazioni importanti

Il presente documento è stato preparato da Intesa Sanpaolo S.p.A. e distribuito da Intesa Sanpaolo SpA-London Branch (membro del London Stock Exchange) e da Intesa Sanpaolo IMI Securities Corp (membro del NYSE e del FINRA). Intesa Sanpaolo S.p.A. si assume la piena responsabilità dei contenuti del documento. Inoltre, Intesa Sanpaolo S.p.A. si riserva il diritto di distribuire il presente documento ai propri clienti. Intesa Sanpaolo S.p.A. è una banca autorizzata dalla Banca d’Italia ed è regolata dall’FCA per lo svolgimento dell’attività di investimento nel Regno Unito e dalla SEC per lo svolgimento dell’attività di investimento negli Stati Uniti.

Comunicazioni importanti

Il presente documento è stato preparato da Intesa Sanpaolo S.p.A. e distribuito da Intesa Sanpaolo SpA-London Branch (membro del London Stock Exchange) e da Intesa Sanpaolo IMI Securities Corp (membro del NYSE e del FINRA). Intesa Sanpaolo S.p.A. si assume la piena responsabilità dei contenuti del documento. Inoltre, Intesa Sanpaolo S.p.A. si riserva il diritto di distribuire il presente documento ai propri clienti. Intesa Sanpaolo S.p.A. è una banca autorizzata dalla Banca d’Italia ed è regolata dall’FCA per lo svolgimento dell’attività di investimento nel Regno Unito e dalla SEC per lo svolgimento dell’attività di investimento negli Stati Uniti.

Le opinioni e stime contenute nel presente documento sono formulate con esclusivo riferimento alla data di redazione del documento e potranno essere oggetto di qualsiasi modifica senza alcun obbligo di comunicare tali modifiche a coloro ai quali tale documento sia stato in precedenza distribuito. Le informazioni e le opinioni si basano su fonti ritenute affidabili, tuttavia nessuna dichiarazione o garanzia è fornita relativamente all’accuratezza o correttezza delle stesse.

Le performance passate non costituiscono garanzia di risultati futuri.

Lo scopo del presente documento è esclusivamente informativo. In particolare, il presente documento non è, né intende costituire, né potrà essere interpretato, come un documento d’offerta di vendita o sottoscrizione di alcun tipo di strumento finanziario. Inoltre, non deve sostituire il giudizio proprio di chi lo riceve.

Intesa Sanpaolo S.p.A. non assume alcun tipo di responsabilità derivante da danni diretti, conseguenti o indiretti determinati dall’utilizzo del materiale contenuto nel presente documento.

Il presente documento potrà essere riprodotto o pubblicato esclusivamente con il nome di Intesa Sanpaolo S.p.A..

Il presente documento è stato preparato e pubblicato esclusivamente per, ed è destinato all’uso esclusivamente da parte di, Società che abbiano un’adeguata conoscenza dei mercati finanziari, che nell’ambito della loro attività siano esposte alla volatilità dei tassi di interesse, dei cambi e dei prezzi delle materie prime e che siano finanziariamente in grado di valutare autonomamente i rischi.

Tale documento, pertanto, potrebbe non essere adatto a tutti gli investitori e i destinatari sono invitati a chiedere il parere del proprio gestore/consulente per qualsiasi necessità di chiarimento circa il contenuto dello stesso.

Per i soggetti residenti nel Regno Unito: il presente documento non potrà essere distribuito, consegnato o trasmesso nel Regno Unito a nessuno dei soggetti rientranti nella definizione di “private customers” così come definiti dalla disciplina dell’FCA.

Per i soggetti di diritto statunitense: il presente documento può essere distribuito negli Stati Uniti solo ai soggetti definiti ‘Major U.S. Institutional Investors’ come definito dalla SEC Rule 15a-6. Per effettuare operazioni mobiliari relative a qualsiasi titolo menzionato nel presente documento è necessario contattare Intesa Sanpaolo IMI Securities Corp. negli Stati Uniti (vedi sotto il dettaglio dei contatti).

Intesa Sanpaolo S.p.A. pubblica e distribuisce ricerca ai soggetti definiti ‘Major U.S. Institutional Investors’ negli Stati Uniti solo attraverso Intesa Sanpaolo IMI Securities Corp., 1 William Street, New York, NY 10004, U.S.A, Tel: (1) 212 326 1199.

Incentivi relativi alla ricerca

Ai sensi di quanto previsto dalla Direttiva Delegata 593/17 UE, il presente documento è classificabile quale incentivo non monetario di minore entità in quanto:

– contiene analisi macroeconomiche (c.d. Macroeconomic Research) o è relativo a Fixed Income, Currencies and Commodities (c.d. FICC Research) ed è reso liberamente disponibile al pubblico indistinto tramite il sito web della Banca – Q&A on Investor Protection topics – ESMA 35-43-349, Question 8 e 9.

Metodologia di distribuzione

Il presente documento è per esclusivo uso del soggetto che lo riceve da Intesa Sanpaolo e non potrà essere riprodotto, ridistribuito, direttamente o indirettamente, a terzi o pubblicato, in tutto o in parte, per qualsiasi motivo, senza il preventivo consenso espresso da parte di Intesa Sanpaolo.

Il copyright ed ogni diritto di proprietà intellettuale sui dati, informazioni, opinioni e valutazioni di cui alla presente scheda informativa è di esclusiva pertinenza del Gruppo Bancario Intesa Sanpaolo, salvo diversamente indicato. Tali dati, informazioni, opinioni e valutazioni non possono essere oggetto di ulteriore distribuzione ovvero riproduzione, in qualsiasi forma e secondo qualsiasi tecnica ed anche parzialmente, se non con espresso consenso per iscritto da parte di Intesa Sanpaolo.

Chi riceve il presente documento è obbligato a uniformarsi alle indicazioni sopra riportate.

Metodologia di valutazione

Il presente documento è stato preparato sulla base della seguente metodologia.

Dati Macroeconomici

I commenti sui dati macroeconomici vengono elaborati sulla base di notizie e dati macroeconomici e di mercato disponibili tramite strumenti informativi quali Bloomberg e Refinitiv-Datastream. Le previsioni macroeconomiche e sui tassi d’interesse sono realizzate dalla Direzione Studi e Ricerche di Intesa Sanpaolo, tramite modelli econometrici dedicati. Le previsioni sono ottenute mediante l’analisi delle serie storico-statistiche rese disponibili dai maggiori data provider ed elaborate sulla base anche dei dati di consenso tenendo conto delle opportune correlazioni fra le stesse.

Previsioni Comparto Energetico

I commenti sul comparto energetico vengono elaborati sulla base di notizie e dati macroeconomici e di mercato disponibili tramite strumenti informativi quali Bloomberg e Refinitiv-Datastream. Le stime di consenso, se non diversamente specificato, provengono dalle principali Agenzie internazionali sull’energia, su tutte l’IEA (International Energy Agency – che si occupa del settore a livello mondiale), l’EIA (Energy Information Administration – istituto che si occupa specificatamente del settore energetico USA) e l’OPEC. Le previsioni sono realizzate dalla Direzione Studi e Ricerche di Intesa Sanpaolo tramite modelli dedicati.

Previsioni Comparto Metalli

I commenti sul comparto metalli vengono elaborati sulla base di notizie e dati macroeconomici e di mercato disponibili tramite strumenti informativi quali Bloomberg e Refinitiv-Datastream.

Le stime di consenso sui metalli preziosi, se non diversamente specificato, provengono principalmente dalla GFMS, la storica agenzia di previsioni basata a Londra. Le previsioni riguardano: oro, argento, platino e palladio. Le previsioni sono realizzate dalla Direzione Studi e Ricerche di Intesa Sanpaolo tramite modelli dedicati.

Le stime di consenso sui metalli industriali, se non diversamente specificato, provengono principalmente dalla Brook Hunt, agenzia di previsioni indipendente che dal 1975 redige statistiche e previsioni su metalli e minerali, e dal World Bureau of Metal Statistics (WBMS), una struttura indipendente di ricerca sul mercato globale dei metalli industriali che pubblica una serie di analisi statistiche con cadenza mensile, trimestrale e annuale. Le previsioni sono realizzate dalla Direzione Studi e Ricerche di Intesa Sanpaolo tramite modelli dedicati.

Previsioni Comparto Agricolo

I commenti sul comparto agricolo vengono elaborati sulla base di notizie e dati macroeconomici e di mercato disponibili tramite strumenti informativi quali Bloomberg e Refinitiv-Datastream.

Le stime di consenso sui prodotti agricoli sono molteplici. Ogni singolo paese ha la propria agenzia interna di statistica che stima e prevede i raccolti, la capacità produttiva, la quantità di offerta di prodotti e soprattutto la quantità (assoluta e percentuale) di terra disponibile per la messa a coltura di un determinato prodotto.

A livello internazionale le principali agenzie sono: l’USDA (United States Department of Agricolture) che, oltre a fornire i dati relativi al territorio americano, si occupa in generale anche del settore granaglie a livello mondiale mediante il sottocomparto della FAS (Foreign Agricultural Service); l’Economist Intelligence Unit, del Gruppo Economist, che si occupa trasversalmente di tutti i prodotti agricoli a livello mondiale; e la CONAB (Companhia Naciònàl de Abastecimento), l’agenzia del Governo brasiliano che si occupa di agricoltura (con un occhio di riguardo per il caffè) e che fornisce anche uno sguardo su tutto il continente sudamericano.

Le previsioni sono realizzate dalla Direzione Studi e Ricerche di Intesa Sanpaolo tramite modelli dedicati.

Livelli tecnici

I commenti sui livelli tecnici si basano sulle notizie e i dati di mercato disponibili tramite strumenti informativi quali Bloomberg e Refinitiv-Datastream. Le previsioni sui livelli tecnici di interesse sono realizzate dalla Direzione Studi e Ricerche di Intesa Sanpaolo tramite modelli tecnici dedicati. Le previsioni sono ottenute mediante l’analisi delle serie storico-statistiche rese disponibili dai maggiori data provider ed elaborate sulla base anche dei dati di consenso tenendo conto delle opportune correlazioni fra le stesse. Vi è inoltre un approfondimento legato alla scelta degli opportuni strumenti derivati che meglio rappresentano il comparto o la specifica commodity su cui si vuole investire.

Raccomandazioni

Outlook Negativo: la raccomandazione di outlook Negativo per un settore è un’indicazione di ampio respiro. Essa indica non solo il deteriorarsi delle condizioni di prezzo degli indici o dei future che meglio rappresentano la materia prima in questione (quindi il ridursi di una performance di prezzo), ma implica anche la riduzione delle previsioni produttive, climatiche e di approvvigionamento (energetico o idrico) che caratterizzano, più di altri strumenti finanziari, questi comparti.

Outlook Neutrale: la raccomandazione di outlook Neutrale per un settore è un’indicazione che abbraccia molti aspetti. Essa indica che la combinazione delle previsioni di prezzo per gli indici e i future e l’insieme delle condizioni produttive, climatiche e di approvvigionamento (energetico o idrico) porteranno ad un movimento laterale dei prezzi o delle scorte o della capacità produttiva, registrando perciò performance nulle o minime per il comparto in esame.

Outlook Positivo: la raccomandazione di outlook Positivo per un settore è un’indicazione di ampio spettro. Essa indica non solo il miglioramento netto delle condizioni di prezzo degli indici o dei future che meglio rappresentano la materia prima in questione (quindi una performance positiva di prezzo), ma implica anche il miglioramento delle previsioni produttive, climatiche e di approvvigionamento (energetico o idrico) che caratterizzano, più di altri strumenti finanziari, questi comparti.

Frequenza e validità delle previsioni

Le indicazioni di mercato si riferiscono a un orizzonte temporale di breve periodo (il giorno corrente o i giorni successivi, salvo diversa indicazione specificata nel testo). Le previsioni sono sviluppate su un orizzonte temporale compreso tra una settimana e 5 anni (salvo diversa indicazione specificata nel testo) e hanno una validità massima di tre mesi.

Comunicazione dei potenziali conflitti di interesse

Intesa Sanpaolo S.p.A. e le altre società del Gruppo Bancario Intesa Sanpaolo (di seguito anche solo “Gruppo Bancario Intesa Sanpaolo”) si sono dotate del “Modello di organizzazione, gestione e controllo ai sensi del Decreto Legislativo 8 giugno 2001, n. 231” (disponibile sul sito internet di Intesa Sanpaolo, all’indirizzo: https://group.intesasanpaolo.com/it/governance/dlgs-231-2001) che, in conformità alle normative italiane vigenti ed alle migliori pratiche internazionali, include, tra le altre, misure organizzative e procedurali per la gestione delle informazioni privilegiate e dei conflitti di interesse, ivi compresi adeguati meccanismi di separatezza organizzativa, noti come Barriere informative, atti a prevenire un utilizzo illecito di dette informazioni nonché a evitare che gli eventuali conflitti di interesse che possono insorgere, vista la vasta gamma di attività svolte dal Gruppo Bancario Intesa Sanpaolo, incidano negativamente sugli interessi della clientela.

In particolare, l’esplicitazione degli interessi e le misure poste in essere per la gestione dei conflitti di interesse – facendo riferimento a quanto prescritto dagli articoli 5 e 6 del Regolamento Delegato (UE) 2016/958 della Commissione, del 9 marzo 2016, che integra il Regolamento (UE) n. 596/2014 del Parlamento europeo e del Consiglio per quanto riguarda le norme tecniche di regolamentazione sulle disposizioni tecniche per la corretta presentazione delle raccomandazioni in materia di investimenti o altre informazioni che raccomandano o consigliano una strategia di investimento e per la comunicazione di interessi particolari o la segnalazione di conflitti di interesse e successive modifiche ed integrazioni, dal FINRA Rule 2241, così come dal FCA Conduct of Business Sourcebook regole COBS 12.4 – tra il Gruppo Bancario Intesa Sanpaolo e gli Emittenti di strumenti finanziari, e le loro società del gruppo, nelle raccomandazioni prodotte dagli analisti di Intesa Sanpaolo S.p.A. sono disponibili nelle “Regole per Studi e Ricerche” e nell’estratto del “Modello aziendale per la gestione delle informazioni privilegiate e dei conflitti di interesse”, pubblicato sul sito internet di Intesa Sanpaolo S.p.A all’indirizzo https://group.intesasanpaolo.com/it/research/RegulatoryDisclosures. Tale documentazione è disponibile per il destinatario dello studio anche previa richiesta scritta al Servizio Conflitti di interesse, Informazioni privilegiate ed altri presidi di Intesa Sanpaolo S.p.A., Via Hoepli, 10 – 20121 Milano – Italia.

Inoltre, in conformità con i suddetti regolamenti, le disclosure sugli interessi e sui conflitti di interesse del Gruppo Bancario Intesa Sanpaolo sono disponibili all’indirizzo https://group.intesasanpaolo.com/it/research/RegulatoryDisclosures/archivio-dei-conflitti-di-interesse ed aggiornate almeno al giorno prima della data di pubblicazione del presente studio. Si evidenzia che le disclosure sono disponibili per il destinatario dello studio anche previa richiesta scritta a Intesa Sanpaolo S.p.A. – Macroeconomic Analysis, Via Romagnosi, 5 – 20121 Milano – Italia.

Intesa Sanpaolo Spa agisce come market maker nei mercati all’ingrosso per i titoli di Stato dei principali Paesi europei e ricopre il ruolo di Specialista in Titoli di Stato, o similare, per i titoli emessi dalla Repubblica d’Italia, dalla Repubblica Federale di Germania, dalla Repubblica Ellenica, dal Meccanismo Europeo di Stabilità e dal Fondo Europeo di Stabilità Finanziaria.