Ottimizzazione e riduzione del consumo d’acqua nei processi di trattamento superficiale

Ottimizzazione e riduzione del consumo d’acqua nei processi di trattamento superficiale

a speech by O. Balestrino

Introduzione

La presentazione si propone di evidenziare l’evoluzione dell’approccio ambientale nel corso degli anni da parte del legislatore e proporre alcune soluzioni tecniche per l’ottimizzazione e riduzione del consumo d’acqua nei processi di trattamento superficiale.

ECOTEAM spa

progetta, realizza, manutiene impianti di trattamento acque ed acque reflue.

Specializzata nel settore Trattamento e Finiture

Sviluppo della “Coscienza Ambientale” in Italia ed in Europa

- Legge 319/1976 (Legge Merli)

- D.lgs 152/2006

- 2019: “Industria 4.0”

- 2022: DNSH

La legge Merli indicava in maniera dettagliata le sostanze inquinanti, ponendo dei limiti al loro scarico nelle acque e alla loro concentrazione. Con riferimento agli scarichi, la ripartizione degli stessi ai fini della relativa disciplina e del conseguente trattamento sanzionatorio era fondata sulla loro provenienza; si disponeva inoltre che lo scarico effettuato in assenza della necessaria autorizzazione, concessa esclusivamente agli scarichi rispettosi dei limiti di accettabilità, fosse sempre soggetto a sanzione penale.

D.lgs 152 normativa di cui una sezione importante è dedicata appunto alla tutela delle acque dall’inquinamento e alla gestione delle risorse idriche.

Industria 4.0 / Ambiente

Impianti di trattamento acqua inseriti nel gruppo 2 allegato A dei materiali ammessi alla transizione 4.0, ovvero sistemi per l’assicurazione della qualità e della sostenibilità, con particolare riferimento alle due seguenti categorie:

- componenti, sistemi e soluzioni intelligenti per la gestione, l’utilizzo efficiente e il monitoraggio dei consumi energetici e idrici e per la riduzione delle emissioni

- filtri e sistemi di trattamento e recupero di acqua, aria, olio, sostanze chimiche, polveri con sistemi di segnalazione dell’efficienza filtrante e della presenza di anomalie o sostanze aliene al processo o pericolose, integrate con il sistema di fabbrica e in grado di avvisare gli operatori e/o di fermare le attività di macchine e impianti

Green Deal Europeo

Il pilastro centrale di Next Generation EU è il dispositivo Recovery and Resilience Facility che, tra i vari obiettivi, si propone di sostenere interventi che contribuiscano ad attuare l’Accordo di Parigi e gli obiettivi di sviluppo sostenibile delle Nazioni Unite, in coerenza con il Green Deal europeo.

Obiettivo «Inquinamento zero» per un ambiente privo di sostanze tossiche

Do No Significant Harm

ll principio Do No Significant Harm (DNSH) prevede che gli interventi previsti dai PNRR nazionali non arrechino nessun danno significativo all’ambiente: questo principio è fondamentale per accedere ai finanziamenti del RRF.

I piani devono includere interventi che concorrono per il 37% delle risorse alla transizione ecologica.

l principio DNSH si basa su quanto specificato nella “Tassonomia per la finanza sostenibile”, adottata per promuovere gli investimenti del settore privato in progetti verdi e sostenibili nonché contribuire a realizzare gli obiettivi del Green Deal.

Criteri del DNSH

Il Regolamento individua sei criteri per determinare come ogni attività economica contribuisca in modo sostanziale alla tutela dell’ecosistema, senza arrecare danno a nessuno degli obiettivi ambientali

1 Mitigazione dei cambiamenti climatici

Un’attività economica non deve portare a significative emissioni di gas serra (GHG)

2 Adattamento ai cambiamenti climatici

Un’attività economica non deve determinare un maggiore

3 Uso sostenibile e protezione delle risorse idriche

Un’attività economica non deve essere dannosa per il buono stato dei corpi idrici (superficiali, sotterranei o marini) e determinare il deterioramento qualitativo o la riduzione del potenziale ecologico

4 Transizione verso l’economia circolare, con riferimento anche a riduzione e riciclo dei rifiuti

Un’attività economica non deve portare a significative inefficienze nell’utilizzo di materiali recuperati o riciclati, ad incrementi nell’uso diretto o indiretto di risorse naturali, all’incremento significativo di rifiuti, al loro incenerimento o smaltimento, causando danni ambientali significativi a lungo termine

5 Protezione e riduzione dell’inquinamento dell’aria, dell’acqua o del suolo

Un’attività economica non deve determinare un aumento delle emissioni di inquinanti nell’aria, nell’acqua o nel suolo

6 Protezione e ripristino della biodiversità e della salute degli eco-sistemi

Un’attività economica non deve dannosa per le buone condizioni e resilienza degli ecosistemi o per lo stato di conservazione degli habitat e delle specie, comprese quelle di interesse per l’Unione

Nace

Uno specifico allegato tecnico della Tassonomia riporta i parametri per valutare se le diverse attività economiche contribuiscano in modo sostanziale alla mitigazione e all’adattamento ai cambiamenti climatici o causino danni significativi ad uno degli altri obiettivi.

Basandosi sul sistema europeo di classificazione delle attività economiche (NACE), vengono quindi individuate le attività che possono contribuire alla mitigazione dei cambiamenti climatici, identificando i settori che risultano cruciali per un’effettiva riduzione dell’inquinamento. Il quadro definito dalla Tassonomia fornisce quindi una guida affidabile affinché le decisioni di investimento siano sostenibili ed è diventato un elemento cardine nei criteri di assegnazione delle risorse europee

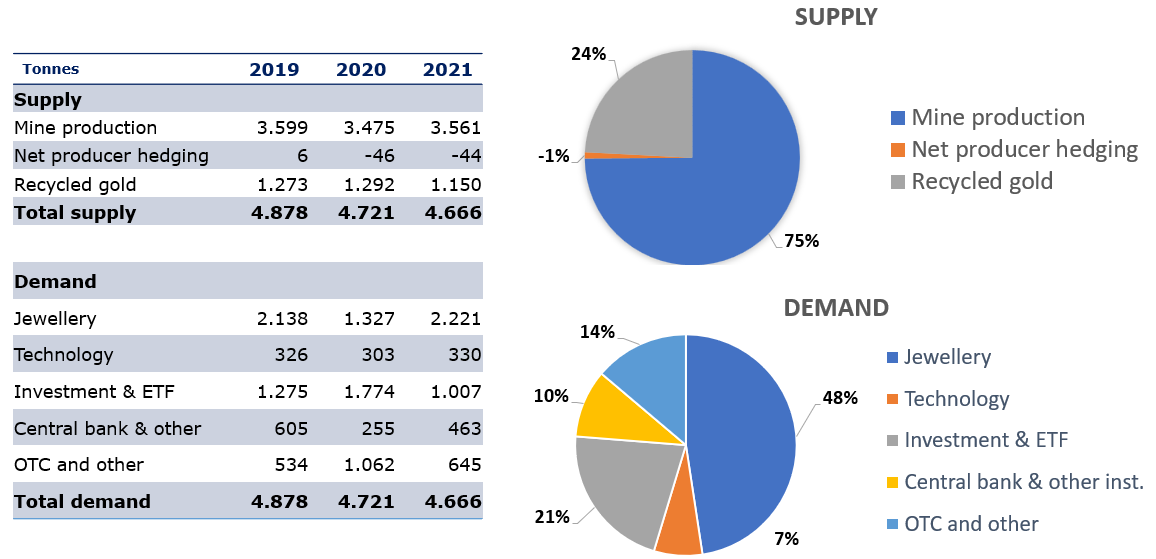

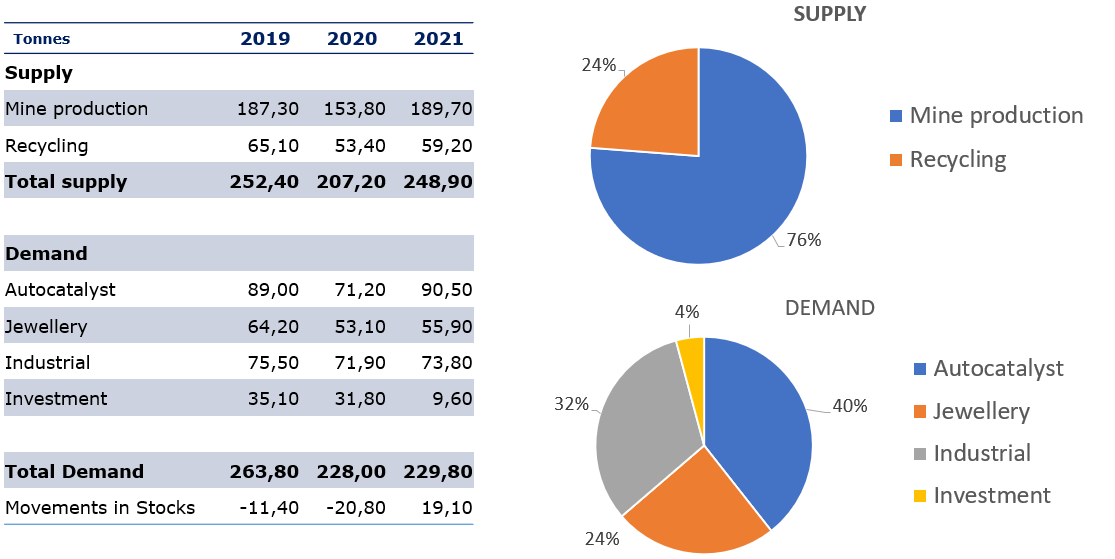

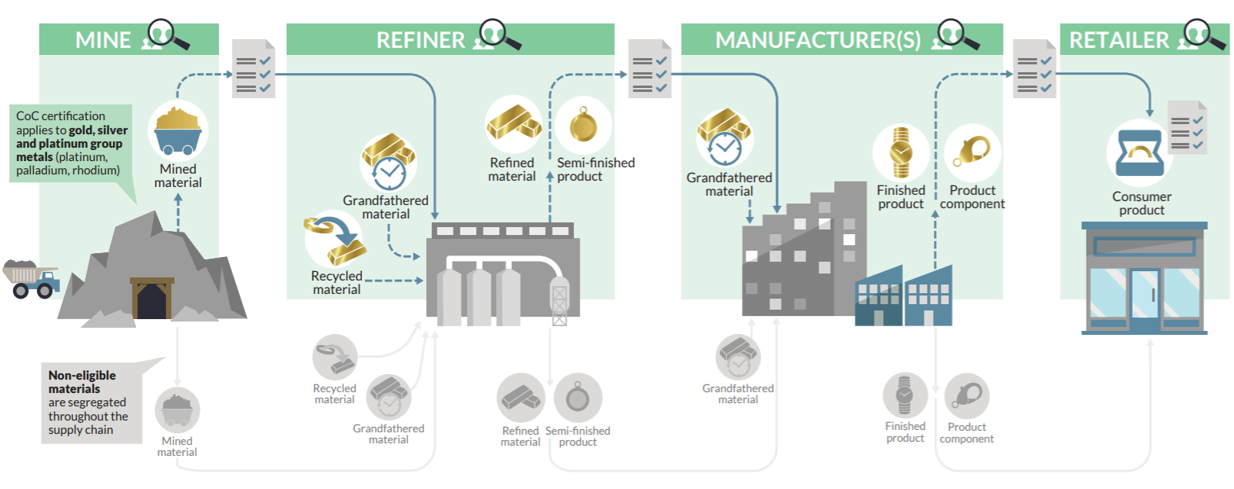

C24 – Manufacture of basic metals

C24.4.1 – Precious metals production

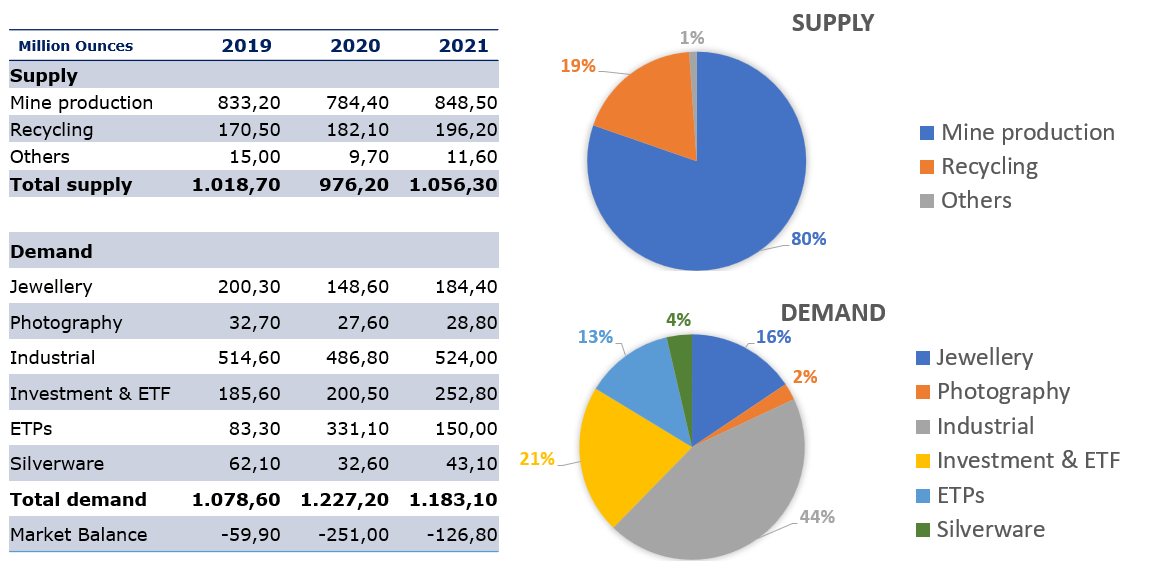

C25 – Manufacture of fabricated metal products, except machinery and equipment

C25.6.1 – Treatment and coating of metals

ECOTEAM

«Inquinamento zero» per un ambiente privo di sostanze tossiche

Uso sostenibile e protezione delle risorse idriche

Un’attività economica non deve essere dannosa per il buono stato dei corpi idrici (superficiali, sotterranei o marini) e determinare il deterioramento qualitativo o la riduzione del potenziale ecologico

Protezione e riduzione dell’inquinamento dell’aria, dell’acqua o del suolo

Un’attività economica non deve determinare un aumento delle emissioni di inquinanti nell’aria, nell’acqua o nel suolo

DNSH nel T.F.

Progettazione impianti a basso impatto

- Utilizzo di prodotti a bassa tossicità

- Progettazione di impianti efficienti

- Riuso e recupero delle soluzioni

- Scarico liquido zero

Lavaggio

Riduzione dell’acqua

La progettazione del sistema di lavaggio è legata a:

1. Processo

a) Caratteristiche della soluzione di processo

b) Numero di lavaggi

c) Tipologia di lavaggi

2. Produzione

I. Superficie

II. Obiettivo finale

Importanza dei lavaggi: Riduzione dell’acqua

Un lavaggio in cascata permette una forte riduzione della portata d’acqua necessaria ed in prima approssimazione possiamo dire che la concentrazione nei lavaggi

DNSH e ZLD

Lo Scarico Liquido Zero può utilizzare diverse tecnologie e filosofie di progettazione ma il punto chiave è l’ultimo anello che è quasi sempre un sistema di evapo-concentrazione.

L’evapo-concentratore è un sistema che permette di concentrare delle soluzioni diluite eliminando/recuperando l’acqua.

Gli utilizzi principali sono:

1. Recupero di soluzioni diluite per essere riutilizzate come soluzioni di processo

2. Riduzione degli smaltimenti con recupero dell’acqua

EVAPO-CONCENTRATORI

Esistono diverse tecnologia di evapo-concentratori:

1.Pompa di calore

1. a serpentina immersa

2. a circolazione forzata

3. con raschiatore

2.Acqua calda

1. a singolo effetto

2. a doppio effetto

3. a triplo effetto

3.Ricompressione Meccanica dei Vapori

1. a circolazione naturale

2. a circolazione forzata

3. falling film

1. Con compressore a lobi

2. Con compressore centrifugo

CONCLUSIONI

La riduzione del consumo d’acqua, fino al punto estremo dello Scarico Liquido Zero, nei processi di trattamento superficiale persegue “l’obiettivo Inquinamento zero per un ambiente privo di sostanze tossiche”.

I costi di esercizio con le opportune tecniche possono essere molto vantaggiosi.